The Federal Reserve is expected to increase curiosity fees by a few-quarters of a proportion place Wednesday and then sign that it could decrease the measurement of its amount hikes starting as shortly as December.

Markets are primed for the fourth 75-basis level hike in a row, and investors are anticipating the Fed will sluggish down its speed ahead of winding down the fee-climbing cycle in March. A foundation issue is equal to .01 of a percentage stage.

“We imagine they hike just to get to the conclude issue. We do feel they hike by 75. We consider they do open up the doorway to a move down in level hikes beginning in December,” mentioned Michael Gapen, main U.S. economist at Financial institution of America.

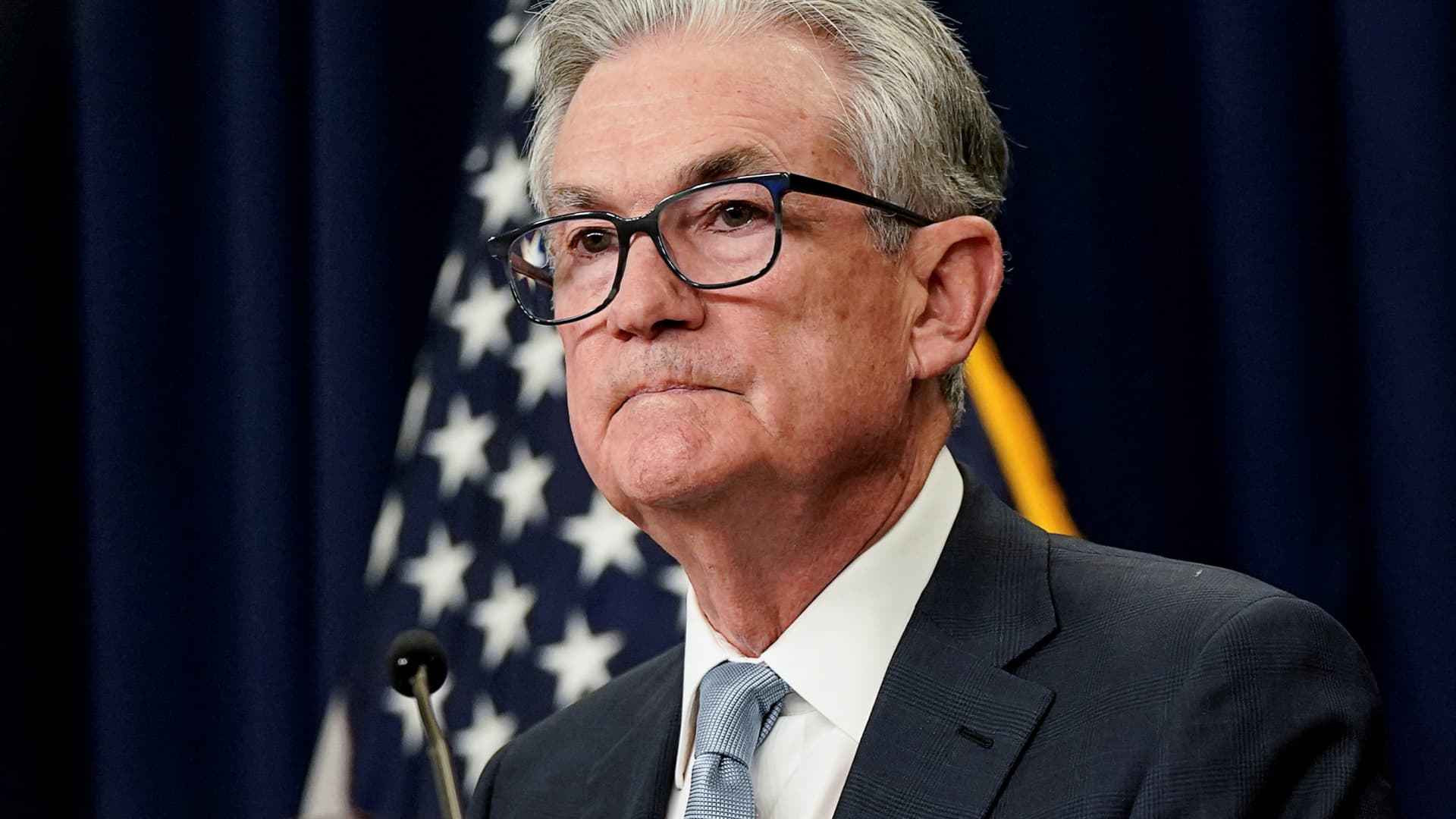

Gapen explained he expects Fed Chair Jerome Powell to show throughout his push briefing that the Fed reviewed slowing the speed of amount hikes but did not commit to it. He expects the Fed would then increase curiosity fees by a 50 percent percentage place in December.

“The November conference isn’t really definitely about November. It really is about December,” Gapen mentioned. He expects the Fed to elevate fees to a degree of 4.75% to 5% by spring, and that would be its terminal level — or end level. The 75 foundation point hike Wednesday would acquire the fed cash price range to 3.75% to 4%, from a assortment of zero to .25% in March.

“The market is quite fixated on the truth you can find going to be 75 in November, 50 [basis points] in December, 25 on Feb. 1 and then possibly a further 25 in March,” stated Julian Emanuel, head of fairness, derivatives and quantitative system at Evercore ISI. “So in truth, the marketplace now thinks this is going on, and from my point of look at, there is certainly no way the final result of his press conference is going to be more dovish than that.”

The inventory sector has currently rallied on expectations of a slowdown in price hikes by the Fed, immediately after a last 75 basis stage hike Wednesday afternoon. But strategists also say the market’s response could be violent if the Fed disappoints. The problem for Powell will be to stroll a fantastic line concerning signaling much less-intense hikes are possible and upholding the Fed’s pledge to battle inflation.

For that rationale, market professionals hope the Fed chair to sound hawkish, and that could rattle stocks and send out bond yields increased. Yields move reverse rate.

“I think he is heading to attempt to execute the fantastic artwork of receiving off the 75 [basis points] devoid of making euphoria and influencing economical situations too effortless,” reported Rick Rieder, BlackRock chief expense officer of world fastened cash flow. “I think the way the marketplace is pricing, I imagine that is what they’re heading to do, but I imagine he’s truly received to thread the needle on not finding individuals also energized about the course of journey. Battling inflation is their primary aim.”

As the Fed has elevated interest costs, the financial state is commencing to demonstrate signals of slowing. The housing sector is slumping, as some mortgage costs have approximately doubled. The 30-yr set amount mortgage loan was at 7.08% in the week of Oct. 28, up from 3.85% in March, in accordance to Freddie Mac.

“I consider [Powell] will say that four 75-basis issue hikes is an dreadful ton and with this prolonged and variable lag, you need to have to step again and see the effects. You are observing it in housing. You are starting off to see it in autos,” said Rieder. “You’re looking at it in some of the retailer slowdowns, and you might be undoubtedly viewing it in the surveys. I imagine the idea that you are slowing, it is significant how he describes it.”

The Fed should really be dependent on incoming information, and even though inflation is coming down, the speed of decrease is unclear, Rieder claimed.

“If inflation continues to be surpisingly higher, he shouldn’t shut off his possibilities,” he reported.

Customer inflation in September ran at a hot 8.2% yearly basis.

Gapen expects the overall economy to dip into a shallow economic downturn in the initial quarter. He stated the fairness market would be anxious if inflation ended up to keep so large the Fed would have to increase rates even a lot more sharply than anticipated, threatening the financial system even additional.

“The markets want to be relieved, particualy the fairness maket,” stated Rieder. “I believe what comes about to the fairness industry and the bond market are various mainly because of the technicals and the leverage. … But I feel the market needs to consider that the Fed, they’re heading to get to 5% and continue to be there for awhile. People are fatigued of having bludgeoned, and I imagine they want to think the bludgeoning is about.”