CNBC’s Jim Cramer on Monday mentioned that the current market could see a rally later on this calendar year that lasts by the end of 2022.

“The charts, as interpreted by Larry Williams, had been ready to phone this unbelievable October rally. … And now he suggests that this market’s possible obtained even extra upside even as a result of the conclude of the yr,” Cramer mentioned.

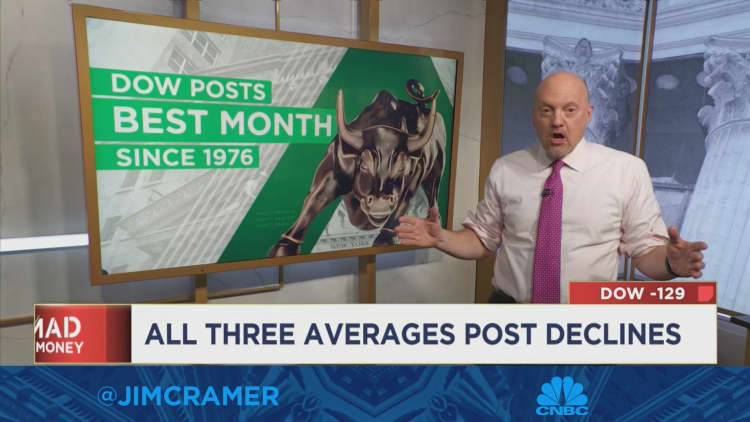

Shares fell on Monday but saw a main comeback in Oct. The Dow Jones Industrial Normal attained 13.95% in its finest month since 1976. The S&P 500 and Nasdaq Composite greater about 8% and 3.9%, respectively, in October.

To explain Williams’ examination, Cramer 1st examined the chart of the Dow Jones Industrial Typical futures in black, and Williams’ genuine seasonal sample in blue.

This chart is an up-to-date version of what Williams made use of previously this month when accurately predicting October’s rally, and suggests there could be a incredible rally, according to Cramer.

“That accurate seasonal pattern is dependent on the historic sample at any specified point in the 12 months, and it predicted a monster run by way of mid-November. And it suggests we’ve got an additional leg higher by way of the close of the yr,” he reported, incorporating that there will be a pause concerning the rallies.

He then examined a chart that demonstrates the motion in the Dow as a result of past week, along with Williams’ lengthy-phrase cycle forecast in pink.

The cycle forecast confirms the bullish previous seasonal forecast in the former chart, according to Cramer.

“Bulls be prepared, bears beware,” he mentioned.

For additional assessment, enjoy Cramer’s comprehensive clarification below.