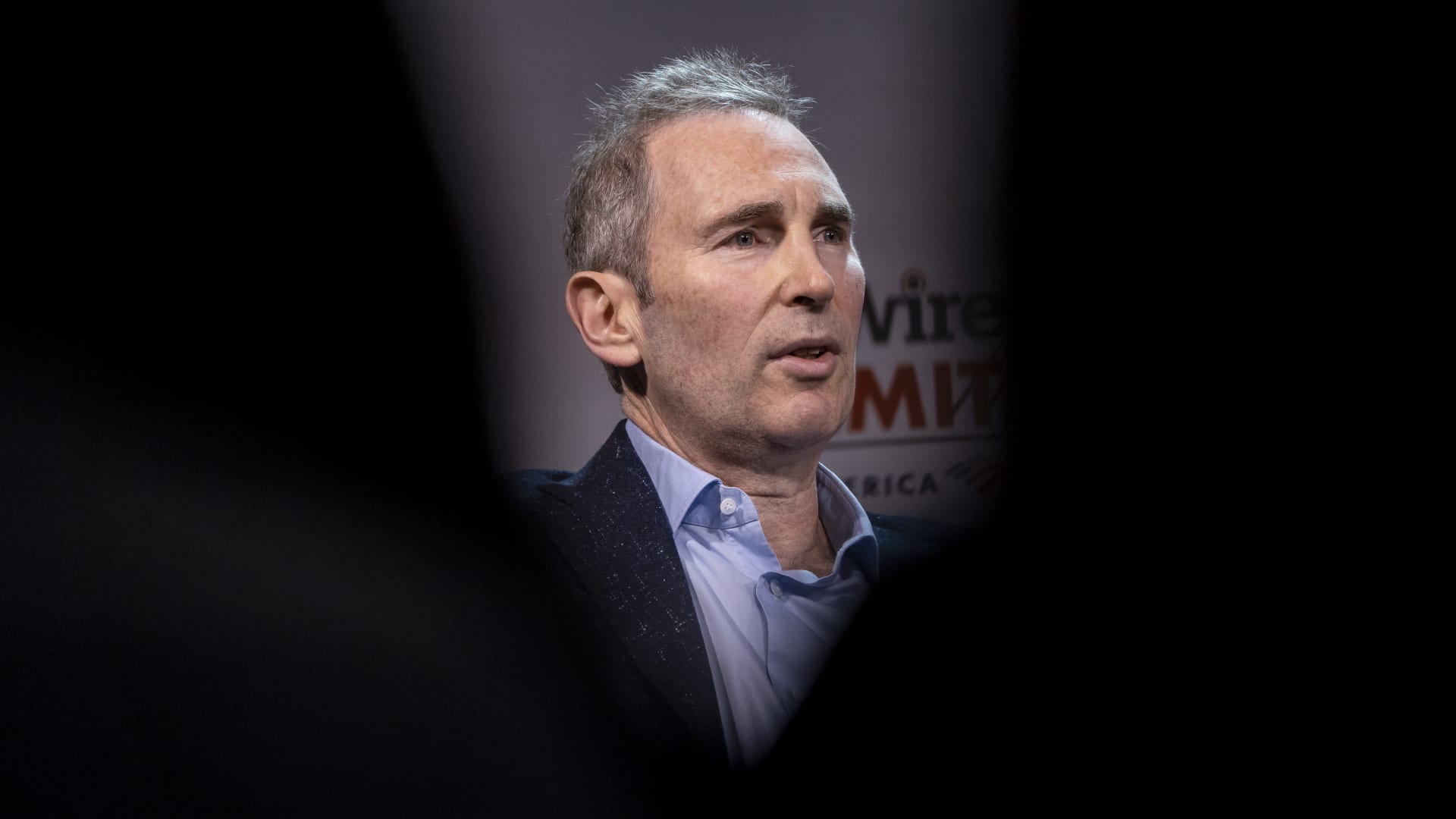

Amazon CEO Andy Jassy speaks through the GeekWire Summit in Seattle on Oct. 5, 2021.

David Ryder | Bloomberg | Getty Photographs

Amazon shares plunged far more than 10% in early trading Friday, a day soon after the firm projected sales in the getaway quarter would be far beneath anticipations.

Shares are now off about 50% from their highs, resulting in about a $940.8 billion hit to Amazon’s price.

Amazon reported Thursday that income would be in between $140 billion and $148 billion in the three-month interval ending the yr, which was much under consensus estimates of $155.15 billion, in accordance to Refinitiv.

Revenue in the third quarter arrived in at $127.10, up 15% calendar year above calendar year, but marginally softer than Wall Street’s anticipated $127.46 billion. Amazon’s cloud business described a 27% revenue development rate for the quarter, which is the slowest progress considering the fact that 2014, when the business began breaking out AWS results.

The final results capped off a rocky earnings 7 days for Major Tech, where Amazon, Alphabet, Meta and Microsoft all skipped anticipations for components of their firms, signaling how document inflation, rising interest rates and fears of a recession are roiling their businesses. Several businesses issued bleak forecasts, indicating much more hassle could lie ahead.

Some analysts on Friday shaved their price tag targets for Amazon’s stock to replicate in the vicinity of-phrase considerations. Nonetheless, many others said they continue being assured in the retail giant’s extended-expression potential customers.

“Over-all, while all of AMZN’s organization units are very likely uncovered to broader macro pressures, we do not perspective 3Q effects or 4Q direction as thesis changing,” wrote JMP Securities’ Nicholas Jones, who managed his market outperform score on Amazon shares, but revised his value focus on down to $140 from $150.

“AMZN’s options within retail and cloud remain persuasive choices, in our belief, and advertising and marketing continues to have a significant opportunity for expansion further than promoted listings,” Jones wrote. “Appropriately, we see AMZN as a finest-in-class world-wide-web enterprise that can not only weather the macro storm, but arise primed to reaccelerate development.”

Wolfe Study analyst Deepak Mathivanan wrote in a notice that Amazon’s fourth-quarter steerage shows it really is not immune to the demanding world-wide macro setting.

“Nevertheless, we imagine the firm is perfectly positioned to navigate a choppy need surroundings with negligible disruption to functions and perhaps obtain share from sub-scale gamers,” reported Mathivanan, who retained his outperform rating on Amazon shares, but trimmed his price goal to $130 from $150.

Observe: Amazon misses on income, inventory plummets on weak fourth quarter direction