Residence for Sale by Proprietor, Forest Hills, Queens, New York.

Lindsey Nicholson | UCG | Universal Photographs Group | Getty Visuals

Dwelling price ranges are continue to greater than they ended up a 12 months back, but gains are shrinking at the swiftest rate on file, in accordance to just one critical metric, as the housing sector struggles less than sharply larger desire prices.

Price ranges in August were 13% higher nationally in contrast with August 2021, according to the S&P CoreLogic Case-Shiller Home Rate Index. That is down from a 15.6% once-a-year gain in the prior month. The 2.6% big difference in those people month to month comparisons is the greatest in the background of the index, which was introduced in 1987, that means price gains are decelerating at a document tempo.

The 10-city composite, which tracks the most significant housing markets in the United States, rose 12.1% yr about yr in August, versus a 14.9% gain in July. The 20-city composite, which contains a broader array of metropolitan places, was up 13.1%, in contrast with a 16% maximize the prior month.

“The forceful deceleration in U.S. housing price ranges that we pointed out a thirty day period back continued in our report for August 2022,” wrote Craig Lazzara, Taking care of Director at S&P DJI in a launch. “Value gains decelerated in each a single of our 20 towns. These knowledge show obviously that the progress rate of housing selling prices peaked in the spring of 2022 and has been declining ever considering that.”

Top the cost gains in August were being Miami, Tampa and Charlotte, with calendar year-over-12 months increases of 28.6%, 28% and 21.3%, respectively. All 20 metropolitan areas noted reduce price tag increases in the calendar year ending in August compared to the year ending in July.

The West Coast, which incorporates some of the costliest housing marketplaces, saw the major month-to-month declines, with San Francisco (-4.3%), Seattle (-3.9%) and San Diego (-2.8%) falling the most.

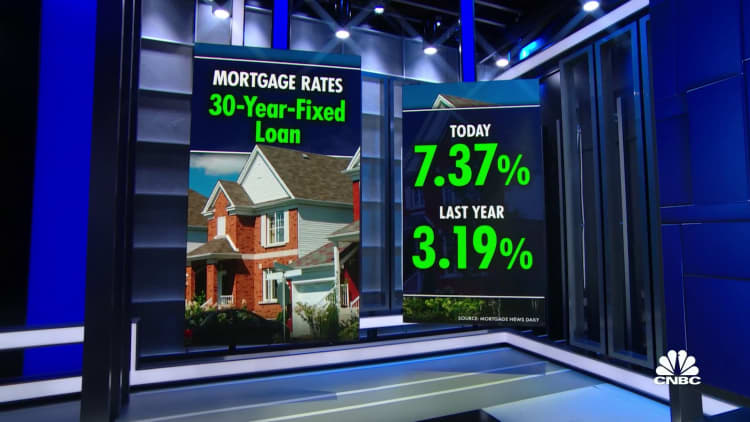

A brief jump in mortgage loan rates from file lows this calendar year has turned the when red-incredibly hot housing marketplace on its heels. The typical level on the common 30-calendar year fixed house mortgage started this yr proper all-around 3%. By June it stretched about 6% and is now just in excess of 7%, in accordance to House loan Information Day-to-day.

“With month to month property finance loan payments 75% larger than previous 12 months, several first-time purchasers are locked-out of housing markets, not able to locate homes with budgets that have dropped $100,000 in getting power this yr,” mentioned George Ratiu, senior economist at Realtor.com.

He also pointed out that better dwelling price ranges merged with bigger curiosity costs are trying to keep would-be sellers from listing their properties. They show up to be locked in to their decreased prices.