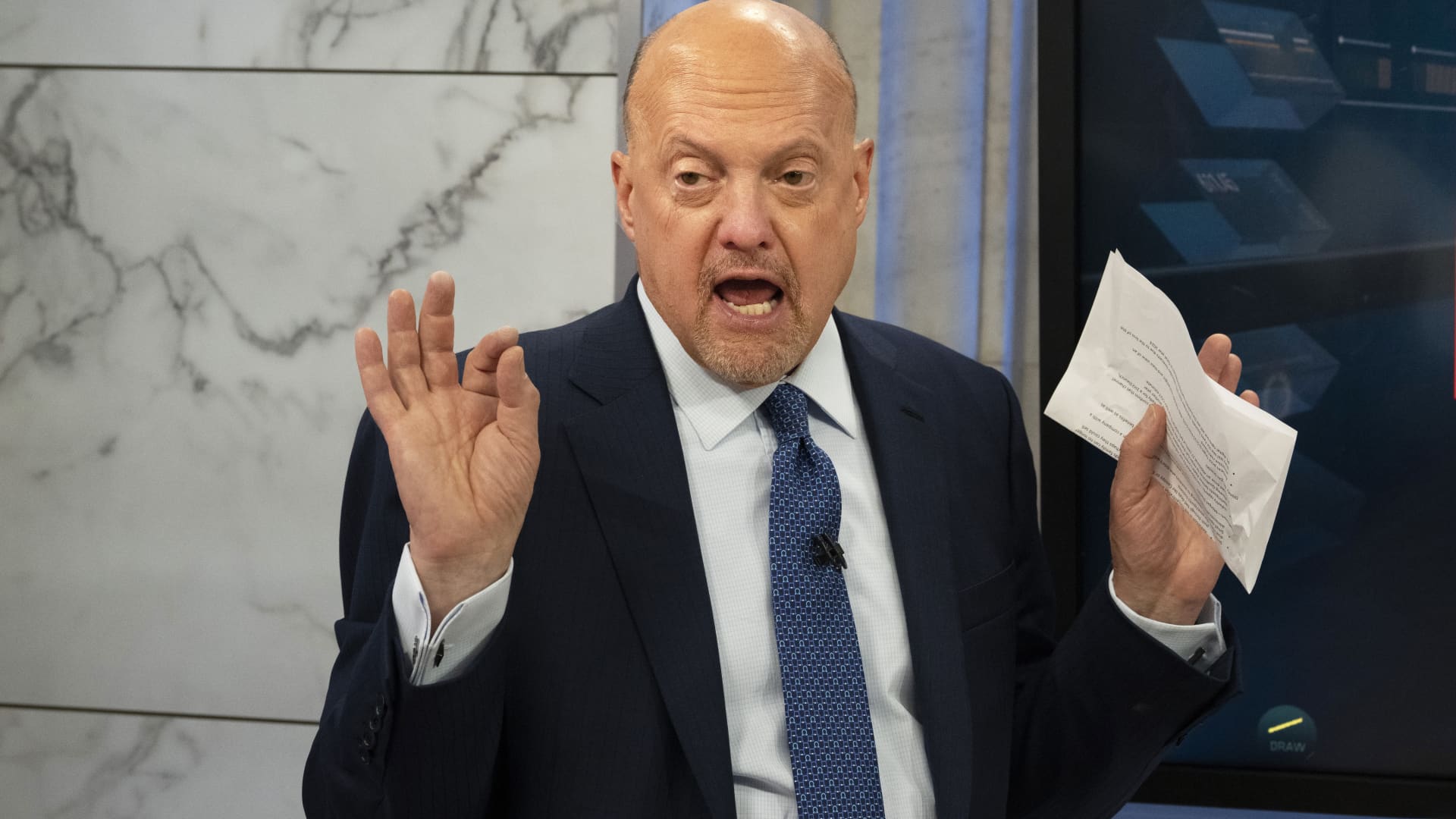

Each and every weekday the CNBC Investing Club with Jim Cramer retains a “Morning Meeting” livestream at 10:20 a.m. ET. This is a recap of Wednesday’s vital times. Keep on to recession-evidence shares Speedy mentions: PG, HAL, PXD, DIS 1. Keep on to recession-evidence shares Amid ongoing current market volatility, the Club continues to be targeted on companies that can endure an impending economic downturn and have reliable harmony sheets. Namely, we like stocks in the health care, financial and electricity sectors. Health care and energy are continue to necessities in an economic slowdown, whilst banking companies are benefiting from greater desire charges. “We are centered uniquely on…providers that do effectively in a recession and urge you not to market them, notably ones with a fantastic balance sheet,” Jim Cramer reported Wednesday. Shares had been generally reduce, with the S & P 500 down .38%, adhering to two consecutive times of gains. We imagine that the sector basically doesn’t have what it requires to manage a sustained rally, supplied persistent headwinds like rising curiosity prices, a solid U.S. dollar and stubborn inflation. 2. Speedy Club mentions: PG, HAL, PXD, DIS Procter & Gamble (PG) conquer Wall Avenue estimates on earnings and profits in its latest quarter described Wednesday, aided by bigger pricing that served offset a decline in revenue volumes and the potent U.S. dollar. We imagine the firm’s functionality demonstrates buyer willingness to pay out for good quality solutions even with value hikes, and stay bullish on the stock. Shares of PG had been up all over 2% in mid-morning trading, at about $131 a share. Jeffries initiated protection on Halliburton (HAL) with a $40 value focus on and invest in ranking. We like HAL, especially due to its strong free hard cash circulation growth, and stand by the oil solutions company. Shares of HAL were being up far more than 3.5% Wednesday, at around $31.5 a share. Morgan Stanley downgraded Pioneer Organic Means (PXD) to underweight. Having said that, we have faith that CEO Scott Sheffield is steering the corporation in the proper way, and advise traders obtain the inventory into any weak spot. “In the oil business, you go with the operator,” Jim said. Netflix (NFLX) on Wednesday explained it included 2.41 million internet world-wide subscribers in the 3rd quarter, more than double the growth the corporation projected a quarter prior, while beating earnings and revenue estimates. The inventory soared extra than 14% on the news. Whilst we don’t personal Netflix, we think this is a good readthrough for club holding Disney (DIS), and urge investors to invest in the inventory. Shares of Disney were being up more than 2% in mid-morning investing, at around $100.55 a share. (Jim Cramer’s Charitable Have confidence in is lengthy DIS, HAL, PG, PXD. See in this article for a whole list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade notify in advance of Jim tends to make a trade. Jim waits 45 minutes just after sending a trade alert prior to shopping for or providing a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC Tv set, he waits 72 hours soon after issuing the trade notify prior to executing the trade. THE Previously mentioned INVESTING CLUB Details IS Subject matter TO OUR Conditions AND Disorders AND Privateness Plan , Jointly WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR Duty EXISTS, OR IS Established, BY Advantage OF YOUR RECEIPT OF ANY Information Presented IN Link WITH THE INVESTING CLUB. NO Unique Final result OR Revenue IS Guaranteed.