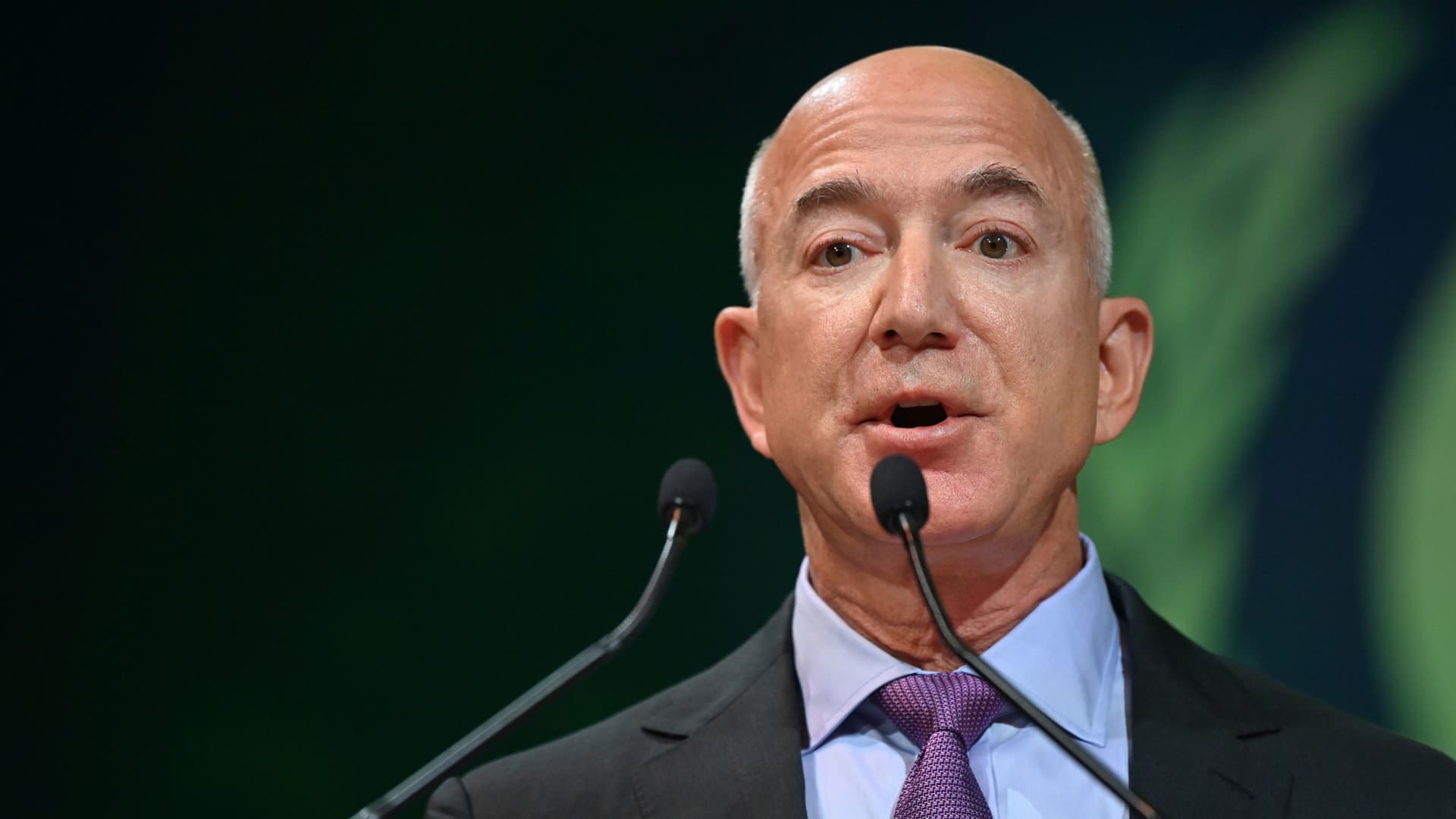

Amazon CEO Jeff Bezos speaks throughout the UN Weather Alter Conference (COP26) in Glasgow, Scotland, Britain, November 2, 2021.

Paul Ellis | Reuters

Amazon founder Jeff Bezos has come to be the most current company chief to warn about the point out of the financial system, cautioning that rougher periods are likely ahead.

In a tweet posted Tuesday evening, the previous president and CEO of the on the internet retailing large echoed reviews that Goldman Sachs Chief Government David Solomon produced to CNBC earlier in the working day.

“Yep, the chances in this financial system notify you batten down the hatches,” Bezos reported in a remark attached to a clip of Solomon’s “Squawk Box” job interview.

Solomon, the head of the Wall Road monetary large, claimed it’s time for both of those company leaders and traders to have an understanding of the challenges building up, and to prepare accordingly.

Solomon spoke right after his organization had just posted quarterly earnings results that defeat Wall Street estimates. Nonetheless he said a recession could be looming as the economic system specials with persistently superior inflation and a Federal Reserve attempting to lower selling prices through a sequence of intense desire amount improves.

“I assume you have to count on that you will find more volatility on the horizon,” Solomon stated. “Now, that isn’t going to suggest for positive that we have a definitely tough economic scenario. But on the distribution of results, there’s a great opportunity that we have a economic downturn in the United States.”

Fed officers have also been warning that a recession is achievable as a outcome of the monetary policy tightening, although they hope to keep away from a downturn. Policymakers in September approximated that gross domestic products would increase just .2% in 2022 and rebound in 2023, but to only 1.2%. GDP contracted in the two the first and next quarters this year, meeting a generally held definition of a recession.

There have been combined signals lately from company leaders.

JPMorgan Chase CEO Jamie Dimon has been warning of troubles forward, declaring not long ago that the circumstance is “very, quite significant” and that the U.S. could slip into recession in the following six months.

Even so, Lender of The usa CEO Brian Moynihan advised CNBC on Monday that credit rating card facts and similar data display that buyer investing has held up.

“In the present-day natural environment, the shopper is rather excellent and sturdy,” he mentioned on “Closing Bell.”

Moynihan acknowledged that the Fed’s endeavours could sluggish the economy, but noted that “the consumer’s hanging in there.”