Costs people pay for a extensive wide range of products and services rose far more than envisioned in September as inflation pressures ongoing to weigh on the U.S. financial state.

The customer selling price index for the thirty day period increased .4% for the thirty day period, additional than the .3% Dow Jones estimate, in accordance to the Bureau of Labor Statistics. On a 12-month foundation, so-termed headline inflation was up 8.2%, off its peak close to 9% in June but however hovering around the optimum amounts since the early 1980s.

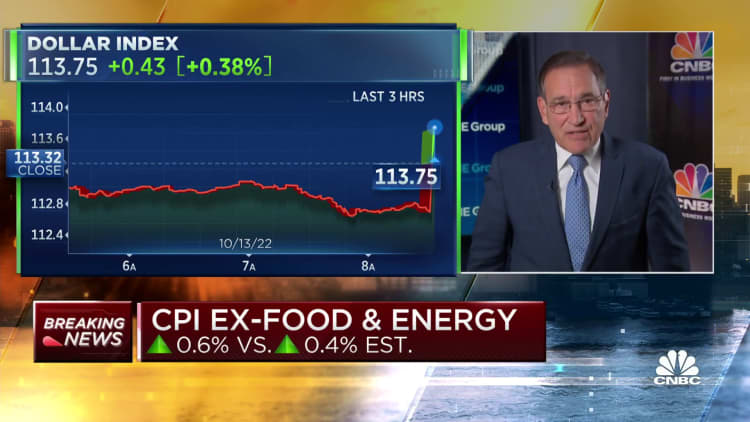

Excluding unstable food stuff and strength prices, core CPI accelerated .6% versus the Dow Jones estimate for a .4% increase. Core inflation was up 6.6% from a year back.

The report rattled fiscal markets, with inventory marketplace futures plunging and Treasury yields going up.

A different large bounce in foodstuff price ranges boosted the headline variety. The foods index rose .8% for the month, the same as August, and was up 11.2% from a 12 months in the past.

That raise aided offset a 2.1% decline in vitality price ranges that bundled a 4.9% fall in gasoline. Vitality costs have moved better in Oct, with the price of typical gasoline at the pump virtually 20 cents increased than a month in the past, according to AAA.

Carefully viewed shelter expenditures, which make up about one-third of CPI, rose .7% and are up 6.6% from a calendar year back. Transportation expert services also confirmed a huge bump, increasing 1.9% on the month and 14.6% on an yearly basis. Clinical treatment fees rose 1% in September.

The mounting expenditures intended far more bad news for personnel, whose average hourly earnings declined .1% for the thirty day period on an inflation-altered basis and are off 3% from a year ago, according to a separate BLS release.

Inflation is rising despite intense Federal Reserve endeavours to get price tag raises under handle.

The central financial institution has lifted benchmark curiosity fees 3 full percentage factors because March. Thursday’s CPI data very likely cements a fourth consecutive .75 percentage issue hike when the Fed up coming fulfills Nov. 1-2, with traders assigning a 98% prospect of that go.

The odds of a fifth straight hike a few-quarter place hike also are growing, with futures pricing in a 62% likelihood pursuing the inflation info.

This is breaking information. Be sure to check out back in this article for updates.