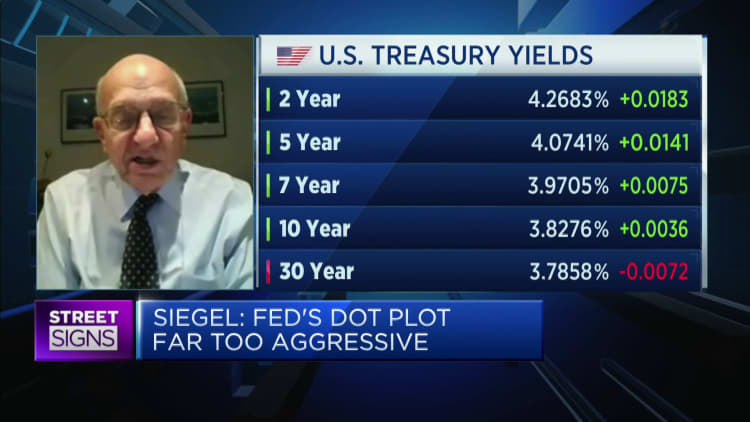

The U.S. Federal Reserve has been boosting fees also immediately, and recession pitfalls will be “particularly” large if it carries on to do so, mentioned Jeremy Siegel, professor emeritus of finance at the Wharton Faculty of the College of Pennsylvania.

“They should have began tightening considerably, considerably significantly previously,” he instructed CNBC’s “Road Signs Asia” on Friday. “But now I concern that they are slamming on the brakes way far too tough.”

Siegel explained he was one of the to start with to alert of the Fed’s “inflationary insurance policies” in 2020 and 2021, but “the pendulum has swung way too much in the other way.”

“If they continue to be as tight as they say they will, continuing to hike premiums via even the early section of following calendar year, the threats of economic downturn are incredibly substantial,” he stated.

Most of the inflation is guiding us, and then the most important danger is economic downturn, not inflation, these days.

Jeremy Siegel

Wharton professor

Official information, which commonly lags by a thirty day period, could not quickly exhibit the alterations taking place in the serious financial state, he said. “Most of the inflation is powering us, and then the largest threat is recession, not inflation, right now.”

Siegel mentioned he thinks desire prices are significant ample that they could bring inflation down to 2%, and the terminal price, or finish stage, should be concerning 3.75% and 4%.

In September, the Fed raised benchmark desire rates by a further 3-quarters of a percentage position to a array of 3%-3.25%, the greatest it has been due to the fact early 2008. The central financial institution also signaled that the terminal rate could be as higher as 4.6% in 2023.

“I imagine that that is way, way too significant — offered the coverage lags, that actually would drive a contraction,” he stated.

In accordance to the CME Group’s FedWatch tracker of Fed money futures bets, the chance that the goal range of rates will arrive at 4.5% to 4.75% in February subsequent year is at 58.3%.

If it ended up up to him, Siegel explained, he would hike charges by 50 percent a point in November, then wait around and see. If commodity selling prices start out to increase and money offer will increase, the Fed would have to do extra.

“But my feeling is that when I search at delicate commodity rates, asset charges, housing price ranges, even rental prices, I see declines, not increases,” he reported.

But not absolutely everyone agrees. Thomas Hoenig, previous president of the Federal Reserve Financial institution of Kansas Metropolis, said fees have to have to be increased for more time.

“My very own see is you’ve got received to get the fee up. If inflation is 8%, you need to have to get the level up a lot better,” he explained to CNBC’s “Street Symptoms Asia.”

“They need to keep there and not again off of that too shortly to in which they reignite inflation, say in the second quarter [of] 2023 or the third quarter,” he additional.

— CNBC’s Jihye Lee contributed to this report.