Mortgage rates drove even higher last week after the Federal Reserve signaled it would continue its aggressive action to cool inflation. That, and rising uncertainty in the overall housing market, caused mortgage application volume to drop 3.7% last week compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index.

After a strange rebound the week before, applications to refinance a home loan declined 11% for the week and were 84% lower than the same week one year ago. They are now at a 22-year low because there are very few borrowers who can benefit from a refinance at today’s higher rates.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 6.52% from 6.25%, with points rising to 1.15 from 0.71 (including the origination fee) for loans with a 20% down payment. That is the highest level since mid-2008.

“After a brief pause in July, mortgage rates have increased more than a percentage point over the past six weeks,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting. “Ongoing uncertainty about the impact of the Fed’s reduction of its MBS and Treasury holdings is adding to the volatility in mortgage rates.”

Mortgage applications to purchase a home decreased 0.4% for the week and were 29% lower than the same week one year ago. Potential buyers today are still contending with high prices, although the annual price gains are now shrinking at a record pace.

Due to the recent jump in rates, the adjustable-rate mortgage share reached 10% of applications and almost 20% of dollar volume because ARMs offer lower interest rates and can be fixed for up to 10 years.

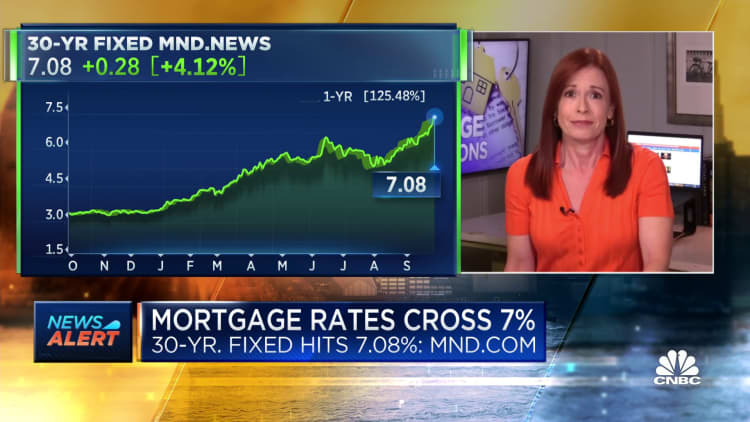

Mortgage rates continued to surge higher this week, crossing 7% on the 30-year fixed to 7.08%, according to a separate survey by Mortgage News Daily. That is the highest rate in just under 20 years.