CNBC’s Jim Cramer on Thursday said that inflation could soon decline, leaning on charts analysis from legendary technician Larry Williams.

“The charts, as interpreted by Larry Williams, suggest that inflation could soon cool down substantially — soon — if history’s any guide,” he said.

The “Mad Money” host’s comments come after the Federal Reserve on Wednesday raised interest rates by another 75 basis points and reiterated its hawkish stance against inflation.

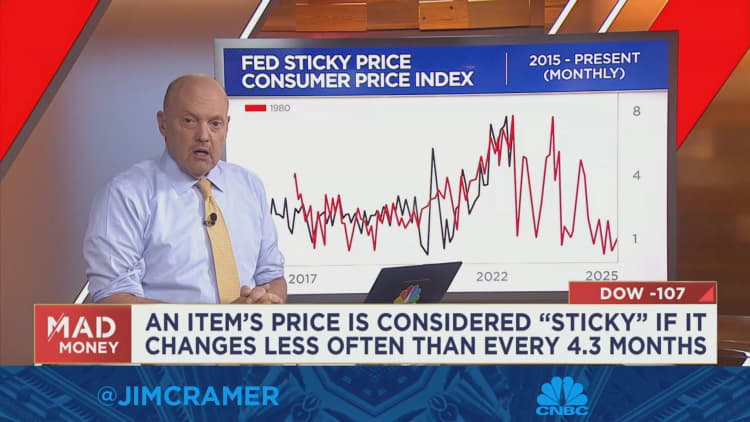

To explain Williams’ analysis, the “Mad Money” host first examined a chart of the current Federal Reserve sticky price consumer price index (in black) compared to the burst of inflation in the late seventies and early eighties (in red).

Williams notes that the current trajectory of sticky price inflation has closely hugged this historical pattern, Cramer said.

He added that when situated in the pattern of inflation in the late seventies and early eighties, current inflation is roughly in the 1980 point of the trajectory — which is around when inflation peaked then.

“Today, unlike back then, the Fed knows exactly how to beat inflation,— and Jay Powell has shown that he’s willing to bring the pain. That means it should peak sooner,” Cramer said.

For more analysis, watch Cramer’s full explanation below.