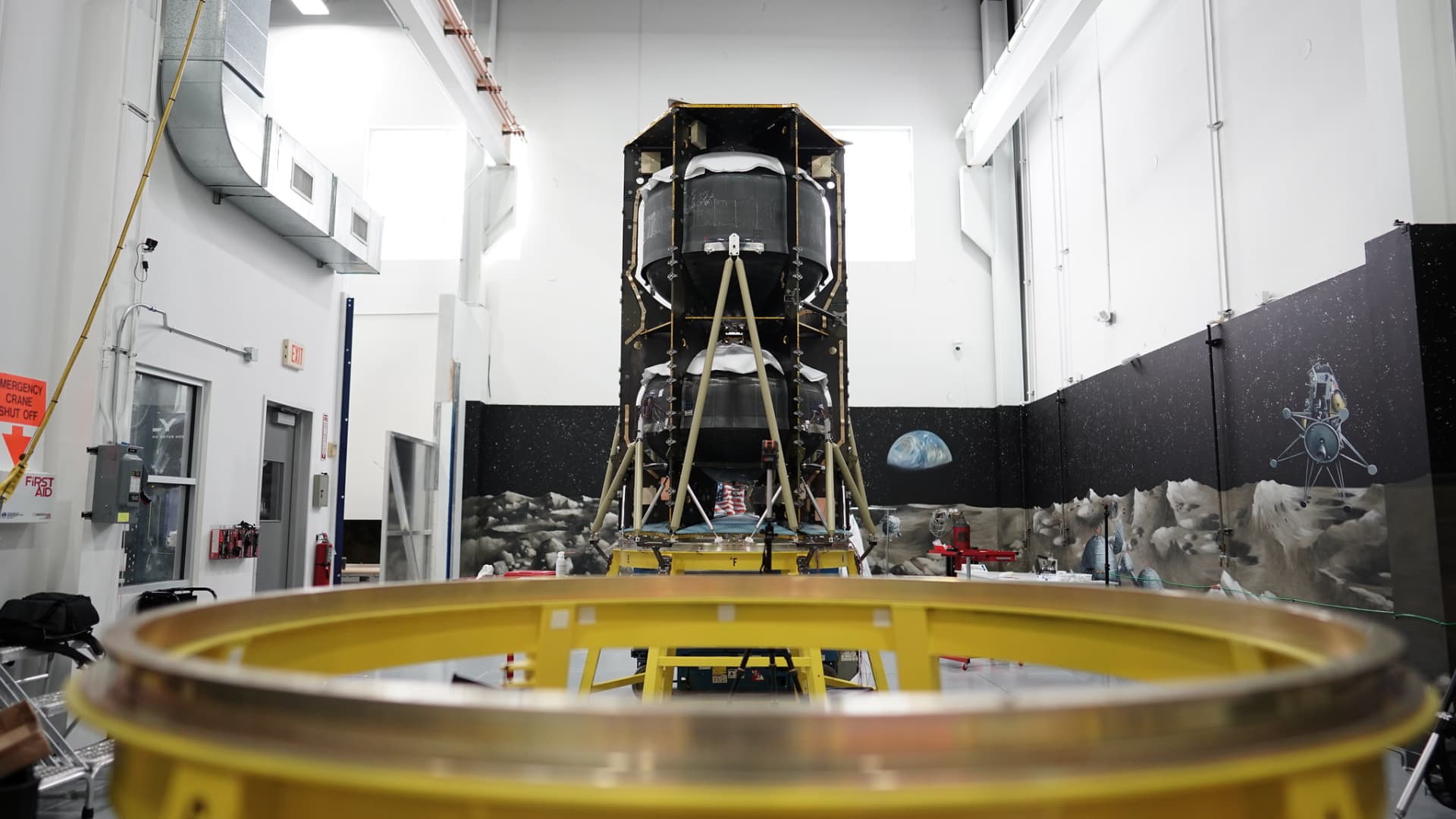

The Nova-C lunar lander seen on April 26, 2022 during assembly for the IM-1 mission.

Intuitive Machines

PARIS — Lunar-focused space company Intuitive Machines announced Friday it will go public via a SPAC, in a deal that values the venture at about $1 billion.

The merger with special purpose acquisition company Inflection Point is expected to close in the first quarter. Intuitive Machines will be listed on the Nasdaq under ticker symbol “LUNR.”

related investing news

“As the United States plans its return to the Moon after a 50-year absence, Intuitive Machines is excited to play a critical role in providing technologies and services to establish long-term lunar infrastructure and commerce,” Intuitive Machines co-founder and executive chairman Kam Ghaffarian said in a statement.

The deal aims to add as much as $338 million in cash to Intuitive Machines balance sheet, although that is dependent on shareholder redemptions.

Intuitive Machines is the latest space company to go public through a SPAC. The announcement comes after a pause in such deals for much of this year after a flurry of space stock debuts in 2020 and 2021. Many of those recently public stocks have taken a beating, with several down 50% or more this year, as investors begin to view the once-hot SPAC frenzy as too risky.

Founded in 2013, Houston-based Intuitive Machines has around 140 employees.

This year, the company expects to bring in $102 million in revenue. It’s forecasting that number to increase to about $291 million in 2023. Intuitive had built a contract backlog worth $188 million as of June and projects it will become profitable in two to three years.

The company has four business units: Lunar Access Services, Lunar Data Services, Orbital Services, and Space Products and Infrastructure. Together, Intuitive Machines is working on a variety of technologies that include propulsion and lunar vehicles.

The company estimates its total addressable market is about $120 billion through 2030, with the vast majority of that coming through lunar services.

One major line of Intuitive’s business is three NASA contracts won under the Commercial Lunar Payload Services program, worth $233 million combined.

The first mission, known as IM-1, is slated for the first quarter of 2023 and would deliver a combination of science and technology payloads to the moon’s surface with the company’s Nova-C lunar lander. Intuitive plans to fly the cargo flights to the moon annually, via contracts with SpaceX to launch with Falcon 9 rockets.