Oil’s current run will likely be short-lived as it’s poised to fall later this fall, CNBC’s Jim Cramer said on Wednesday.

“The charts, as interpreted by Carley Garner, suggest that oil could run to the mid-$90s by early to mid-October, but at that point, she expects it to peak, possibly leading to a big breakdown through the end of the year,” the “Mad Money” host said.

Crude prices have tumbled in recent months after skyrocketing earlier in the year on fears that Russia’s invasion of Ukraine could severely constrain global supply.

There have recently been some bullish signs for oil, Cramer acknowledged. OPEC+, an alliance of OPEC and non-OPEC partners, made a small cut to production targets from October. The Biden administration is also weighing the possibility of refilling the Strategic Petroleum Reserve if prices dip below $80 per barrel, according to Bloomberg.

Yet, oil could very well fall below that price to around $60, he said.

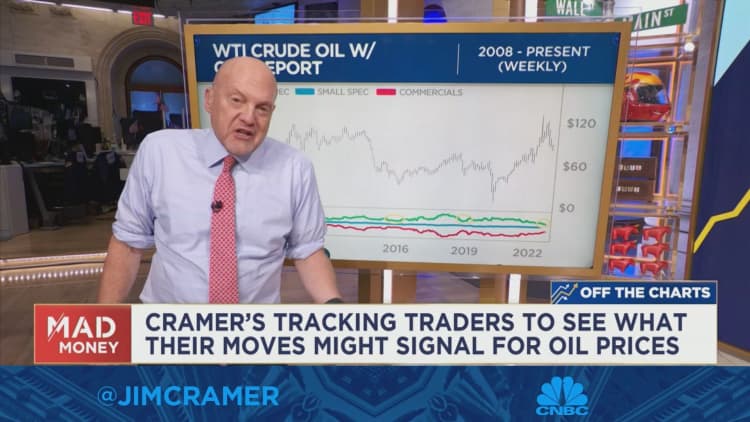

To explain how Garner’s analysis led to that conclusion, he examined the weekly chart of U.S. West Texas Intermediate crude prices:

Cramer said that oil could bounce if the $80 per barrel floor of support shown in the chart holds, and Garner wouldn’t be surprised if oil heads to the low to mid-$90s. Oil could even head higher above $100, but that’s unlikely and would be a “last hurrah” for the commodity, according to Garner, he said.

Cramer added that if oil falls below $80, the next potential floor is at around $60 — and with the Federal Reserve gearing up to raise interest rates next week in its aggressive campaign against inflation, it wouldn’t take much to push oil down even more.

“This is not a commodity that thrives during a Fed-mandated recession,” Cramer said.

For more analysis, watch Cramer’s full explanation in the video below.