CNBC’s Jim Cramer on Wednesday explained that investors urging traders to exit the sector although they continue to can are about a yr as well late.

“I’m done with all the ‘now is the time to get out’ phone calls — where the heck ended up you 10 months in the past when it mattered? It can be not just the submit-Covid kiss of loss of life, it is multiple kisses, a number of fatalities,” he claimed.

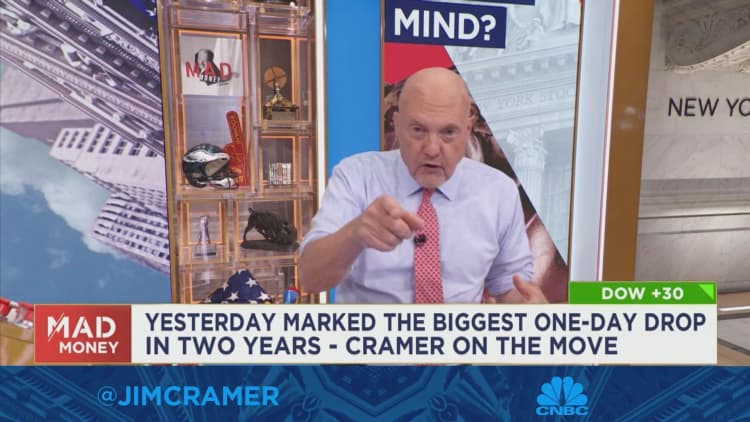

Stocks rose slightly larger on Wednesday as they fought to get better right after the important indexes saw the major single-day drop in more than two decades on Tuesday. Buyers also are eyeing the Federal Reserve’s conference subsequent 7 days, the place it is expected to raise curiosity prices by 75 or 100 foundation points. A foundation point is .01 share stage.

While persistent inflation and the Fed’s struggle against it could further more wreck the sector, the declines are practically nothing new, the “Mad Income” host explained.

According to Cramer, though there are industries that have witnessed big declines this yr, these as tech, there are also decrease-profile bear markets that demonstrate the market place declines have been significantly-reaching.

Vehicle providers have observed losses this yr, as have retail shares, he pointed out. Providers with small business in dwelling renovation have also struggled, even though telecommunications and entertainment stocks have also cratered, he extra.

“We’re now almost a year into this decrease. I just want the so-called gurus would act like it,” Cramer explained.