The most important entrance at JPMorgan’s headquarters in New York Metropolis.

Erik McGregor | LightRocket | Getty Pictures

JPMorgan Chase has agreed to receive a payments startup termed Renovite to fend off threats from fintech firms like Stripe and Block , CNBC has figured out.

The financial institution, a big participant in the world payments arena, reported that buying Fremont, California based Renovite will pace up its ability to roll out new offerings to retailers.

When JPMorgan is the world’s largest provider of merchant expert services by transaction volume, fast-developing upstarts which includes Stripe and Block have climbed the rankings in the latest yrs, thanks to booming e-commerce gross sales and the proliferation of new payment methods. Merchant acquirers are vital, driving-the-scenes companies that allow sellers to take in-human being and on line payments, keeping a small slice of each transaction.

Irrespective of running a payments juggernaut that procedures extra than $9 trillion every day throughout various corporations, JPMorgan’s service provider getting profits stalled very last year in portion simply because it was at the rear of in some e-commerce segments and presented fewer expert services than some fintech rivals, world payments main Takis Georgakopoulos explained to traders in a May perhaps convention.

“Altering that image is a significant tale driving our investments,” Georgakopoulos vowed.

Searching spree

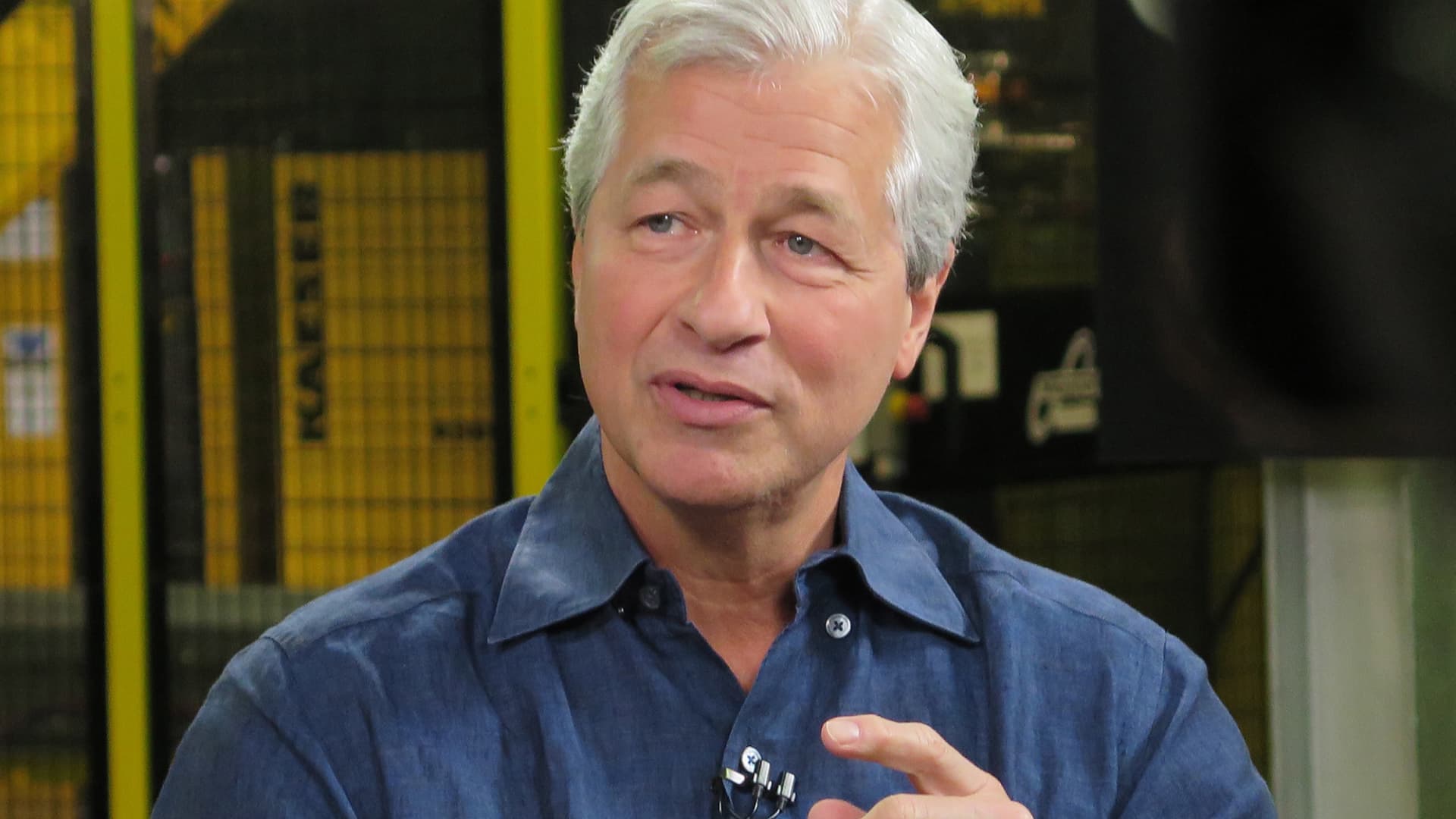

The Renovite acquisition, claimed to start with by CNBC, is the newest in a string of fintech bargains made less than CEO Jamie Dimon. Given that late 2020, JPMorgan has obtained at minimum 5 startups, from an ESG investing system to a Uk-primarily based roboadvisor, on best of generating a collection of smaller sized fintech investments.

Dimon has repeatedly raised the alarm about the risk fintech players pose to conventional banking institutions, particularly in the highly aggressive payments recreation.

Fintech players have utilized payments processing for merchants as a wedge to help them create ecosystems that have garnered eye-watering valuations. They also have commonly been much more nimble in enabling new payment techniques like choices from Klarna and Affirm.

Dimon has been forced to defend his bank’s climbing expenses this year as it plows billions of dollars into technological innovation amid a 25% stock slump driven by recession fears.

The Renovite deal, for terms that could not be determined, exhibits that the longtime CEO is undeterred by problems that he’s spending way too considerably on tech.

From trials to takeover

JPMorgan ran trials with Renovite as a seller past tumble, but was amazed ample with the startup’s goods — specially a cloud-primarily based swap that routes payments to different providers — that it resolved to purchase the corporation outright, according to Mike Blandina, the bank’s global head of payments technology.

The plug-and-enjoy nature of the change system lets JPMorgan to insert new payments alternatives in a portion of the time it utilised to choose for the reason that it necessitates much much less coding, he reported in an job interview.

“Our consumers genuinely worth decision they want to offer you a lot of different payment methods to their customers, regardless of whether it is really Visa, MasterCard, but also Buy-now, fork out-afterwards, and so on,” mentioned Max Neukirchen, the firm’s world head of payments & commerce solutions.

“The capacity to turn on these very state-unique payments procedures also can help us in our geographic enlargement, due to the fact we never will need to invest a large amount of time creating out local payment procedures,” he additional.

Though JPMorgan is often content material to spouse with fintechs and get rather small stakes in them, the bank felt that Renovite’s merchandise was far too critical not to possess, Neukirchen said.

The bank also coveted the firm’s approximately 125 engineers, positioned in India and the U.K., to assistance JPMorgan on its item roadmap, he included.