The U.K.’s freshly elected primary minister Liz Truss is predicted to announce a multi-billion-pound stimulus offer to assist persons with soaring strength prices.

Carl Court docket / Workers / Getty Images

LONDON — The U.K.’s new Prime Minister Liz Truss is set to announce a package truly worth tens of billions of lbs . to enable persons to pay their electricity payments on Thursday, but there are concerns around how it will be funded.

The plan announcement is anticipated to freeze the rate of energy possibly at its present-day amount or at £2,500 ($2,870). As it presently stands the cap coming into influence subsequent month will raise the ordinary strength monthly bill from £1,971 to £3,549 a calendar year.

Truss said she would “deal with the electrical power disaster triggered by Putin’s war” in her maiden speech as key minister on Tuesday evening. “I will choose motion this 7 days to offer with vitality expenditures and to secure our long term electrical power source,” she mentioned.

The announcement is set to arrive as more than 170,000 men and women in the U.K. plan to cancel their vitality invoice payments on Oct. 1 in protest towards the amplified power price tag cap.

The selection of men and women in gas poverty in Britain, defined as becoming unable to adequately heat a household, will hit 12 million households (42%) this winter if monetary guidance isn’t put in place, in accordance to the Conclusion Gasoline Poverty Coalition campaign team.

£180 billion worth of assistance?

The precise facts of the deal have but to be uncovered. Initial projections proposed it may possibly be around £100 billion worth of guidance, but the latest estimates from Deutsche Lender stated it could be nearer to £200 billion.

The Financial institution hiked up its expectations as studies instructed an power invoice freeze would sit at all over the £2,500 stage, which was “a significantly reduced quantity” than the lender had expected, it claimed in a investigate take note Wednesday.

Experiences also advise a £40 billion package will be put in position to aid organizations with their energy prices, according to the bank, bringing the whole of the envisioned assist steps to £180 billion.

It was initially expected that assistance would only be accessible to homes.

The determine is almost fifty percent as a great deal as was used on delivering economical aid for the duration of the Covid-19 pandemic and just more than 8% of gross domestic products, according to Deutsche Bank. It estimates the freeze will be in area from Oct.

‘Bill will finally slide on taxpayers’

The package deal established to be declared by Truss might not be also dissimilar to a plan proposed by the opposition Labour Get together on Aug. 14.

The most important difference is that Labour experienced recommended funding the transfer through a windfall tax on oil and fuel businesses — one thing the new prime minister has dominated out.

“I am towards a windfall tax,” Truss informed the Dwelling of Commons through her very first questioning session with fellow lawmakers on Wednesday.

“I believe that it is the improper matter to be putting providers off investing in the United Kingdom just as we require to be growing the economic system,” she claimed.

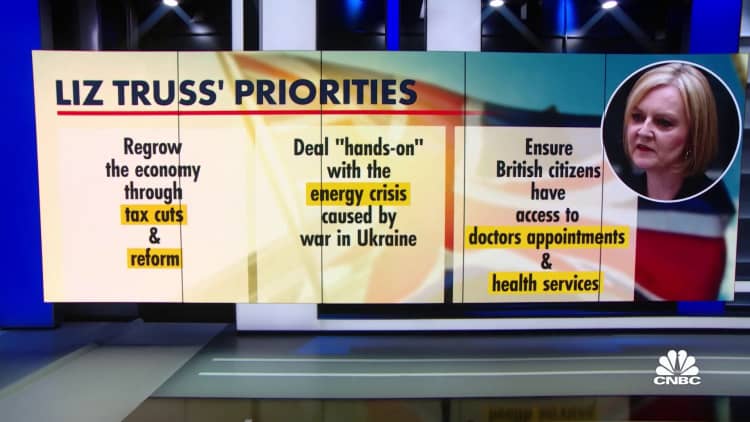

Developing the U.K. economic system by means of “tax cuts and reform” was a single of a few critical mandates laid out by the new key minister in her initial speech Tuesday evening.

The other folks were tackling the vitality crisis and strengthening Britain’s Nationwide Overall health Provider.

The new electrical power package deal will most likely be funded via more federal government borrowing but the aftermath of the financial aid could be felt for decades to come, in accordance to Christopher Dembik, head of macro analysis at Saxo Lender.

“She will have to comply with only one particular path: opening up the door for a huge stimulus deal and, the moment the crisis is settled, raising taxation,” Dembik stated.

“It truly is wonderful information for the short expression, even though the bill will finally tumble on taxpayers in the long operate and could consider generations to pay back off,” he instructed CNBC.

‘It’ll do very little to support us in the winters to come’

An electricity stimulus deal would be a brief-phrase alternative to a lengthier-time period challenge for persons in Britain, according to economist Jeevun Sandher.

“The system as it is currently mentioned would stop the catastrophe coming but the crisis however exists,” he stated, referencing the expense-of-dwelling disaster currently influencing lots of households and corporations in Britain.

“This strength rate freeze may possibly cease that disaster coming this winter, but it’s going to do very little to help us in the winters to arrive,” he said.

The gas sector could also really feel the knock-on results of a stimulus offer, reported Salomon Fiedler, an economist for financial commitment financial institution Berenberg.

“If incumbent utility organizations freeze selling prices now but individually preserve them higher than prices in the foreseeable future, they could be outcompeted by new entrants in the long term which do not have to recuperate existing losses and as a result could undercut them,” Fiedler mentioned.

“A more difficulty is that a typical energy value freeze would take out incentives to reduce gasoline consumption for homes,” Fiedler informed CNBC. “This probable will make the coverage very pricey and maximize the shortage of fuel for sectors not coated by the freeze even further more.”

There is also speculation as to the effect on the economy as a whole. When Truss’ small-tax and deregulation procedures may bolster the financial system, the advantages is not going to be felt for numerous years, or even decades, Fiedler reported.

“In the short run, added fiscal stimulus, be it by means of tax cuts or aid actions, would exacerbate inflation pressures (even as described inflation fees will rely on the information of these steps) if they are not financed by … spending cuts elsewhere,” he wrote.

The price of vitality payments “is undoubtedly the most vital issue to voters right now,” Chris Curtis, head of political polling at Opinium Research. advised CNBC.

“It really is significant as a new primary minister to make a good initially impact and Liz Truss is hoping that by possessing a big intervention on voters’ biggest priority, it can be heading to go some way to earning that beneficial initial impact,” Curtis said.

“Most voters notify us that they continue to you should not know incredibly a lot about her and opinions of her are fairly weak, so it truly is a truly critical second for her to check out and land effectively with the community,” he stated.

‘Impossible challenges’ for the most vulnerable

With warnings that the subsequent 10 years of winters could be “awful” if critical motion is just not taken to command gasoline rates, some are asking if the impending deal will be sufficient to shield the most vulnerable.

Freezing rates at their present-day amount would lead to strength requires to spike and worsen the problem, according to a exploration take note from Sarah Coles, senior personal finance analyst at Hargreaves Lansdown.

“Though everyone having to pay with a direct debit will technically now be spreading bigger costs through the 12 months, people on lower incomes are additional most likely to be on prepayment meters, where by they fork out for the electricity they use at the time they use it,” Coles mentioned.

“If prices are frozen at a a little bit bigger level it will compound the extremely hard troubles experiencing the most susceptible this wintertime,” she explained.