Persons throughout the U.K.’s economic sector are questioning no matter whether the new prime minister will alter the regulatory landscape.

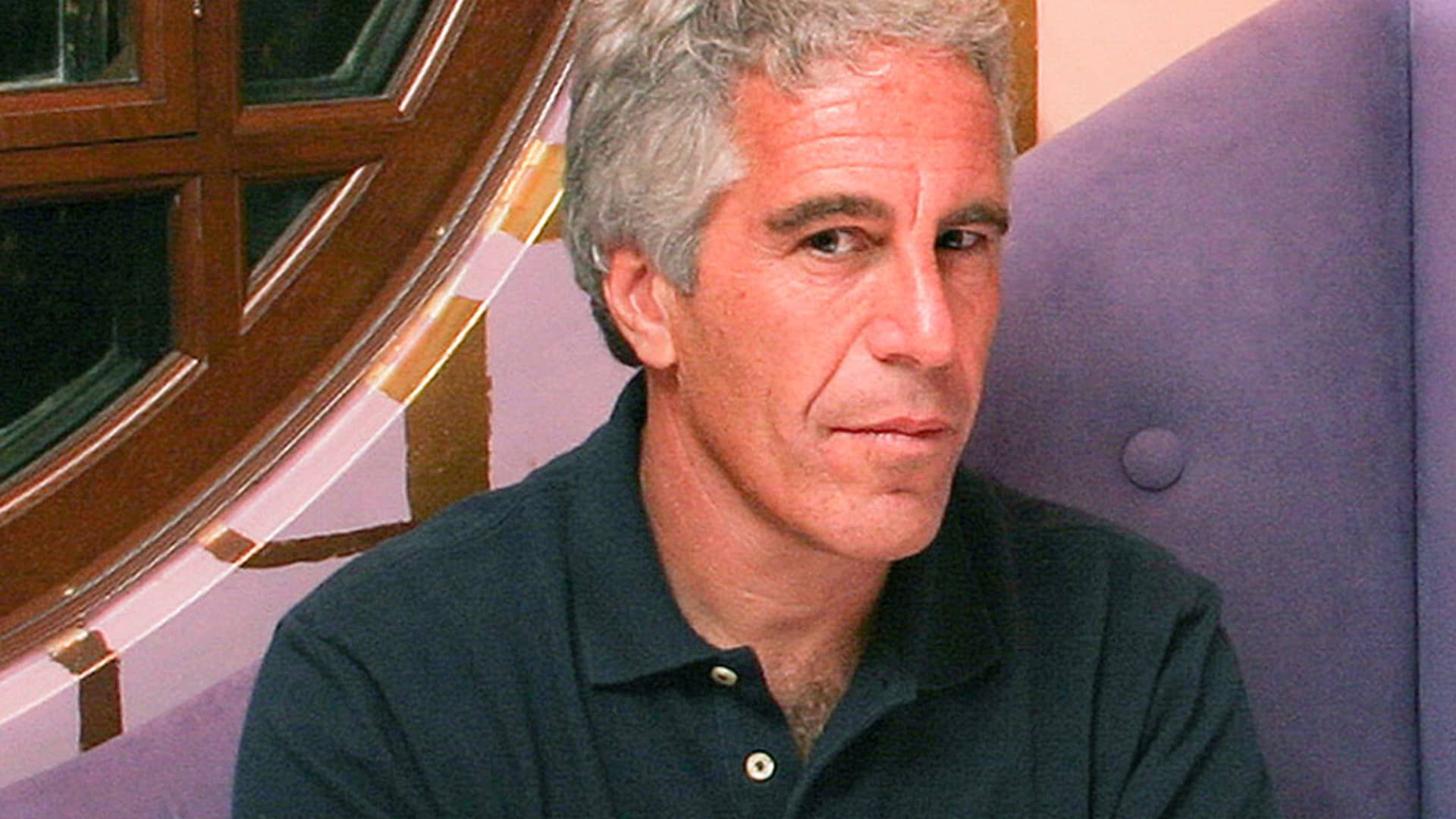

Jeff J Mitchell / Personnel / Getty Visuals

As Liz Truss gets to be Britain’s new key minister on Tuesday, queries are remaining raised around her options for the U.K.’s historic economic district — the Metropolis of London — as the country faces a worsening cost-of-residing crisis and the ongoing conflict in Ukraine.

The City’s regulators could facial area a big shake-up underneath Truss, in accordance to the Monetary Times past month. It cited campaign insiders as saying Truss would find to review and quite possibly merge London’s 3 massive regulators – the Fiscal Conduct Authority (FCA), the Prudential Regulation Authority (PRA) and the Payment Services Regulator (PSR).

She has also instructed the Lender of England’s mandate will be up for overview through her time as key minister.

‘Change for change’s sake’

The FCA regulates 50,000 corporations in the U.K. to “make certain that our monetary markets are truthful, competitive and good,” in accordance to its site. The PRA, meanwhile, oversees the get the job done of all around 1,500 financial institutions, to “assure that the monetary companies and products and solutions that we all count on can be provided in a safe and sound and sound way.”

Their remits seem equivalent, but the distinctive organisations have been formed when it was made a decision the Monetary Services Authority, which controlled the Metropolis involving 2001 and 2013, had various features that could be better served by means of individual organisations.

The major ambitions of the authentic authority have been fantastic carry out and economical soundness across the sector, in accordance to Matthew Nunan, partner at authorized company Gibson Dunn and previous section head at the FCA. He claimed that dividing it into two was witnessed as a way to give these aims equivalent priority.

“The very simple question to be answered now is: What would the rejoining of the PRA and the FCA accomplish?”, Nunan wrote in an e mail to CNBC.

“If the solution is the reformation of the previous Economic Expert services Authority, what was the issue? Or is it simply just modify for change’s sake?”

Governments should generally “obstacle the status quo,” Nunan stated, but argued that it’s a issue of whether or not this would in fact better provide the “transforming desires of a country.”

“The situation listed here is that as an alternative of articulating a difficulty and looking for evidence, the statements produced surface to be proposing solutions to questions nobody is asking,” he reported.

Nunan also highlighted the variation among regulators and politicians, saying that regulators would “in no way be allowed” to make proposals in the way that Truss has.

“Regulators are expected by law to make evidence-dependent conclusions on rule changes [and] require charge advantage examination in advance of they can be implemented … If that is correct for the regulators, why is just not it legitimate for politicians?” he asked.

‘Light touch regulatory regime’

The “fight” to deregulate the banking sector is like “winding the clock again to pre-2008 world-wide money crash,” Fran Boait, director of the campaign group Positive Money, instructed CNBC’s “Squawk Box Europe” previous month.

It threats the country falling into the exact scenario “or a ton even worse,” Boait claimed.

“Liz Truss’ proposal to merge the three critical town watchdogs would threat recreating that light touch regulatory routine – the routine we experienced pre-crash,” she claimed.

She also highlighted that it has been significantly less than a ten years given that the organisations ended up originally started.

“It wasn’t that extensive in the past that we set up a considerably larger regulatory process simply because there was a consensus that there is so significantly threat in the system, [that] complexity in the economical sector wants to be adequately controlled,” she said.

‘Lack of clarity’

Conversations of a critique or merger of any of London’s regulatory bodies remain speculation, as Truss has nonetheless to make any formal statements on the matter.

That does trigger a “lack of clarity” above the long term position of the a few regulators, in accordance to Hargreaves Lansdown Analyst Susannah Streeter.

She claimed that increasing economical services for prospects ought to be at the forefront of any regulatory discussions.

“Irrespective of whether they remain as one or merged entities, it’s genuinely critical that the U.K. has dynamic regulators which make the most of Brexit freedoms,” Streeter claimed in an e-mail to CNBC.

Tackling scams, providing investors a lot more chance to commit at IPOs and addressing how facts is disclosed to potential investors must all be on the agenda for any proposed modifications to the existing regulation procedure, she added.