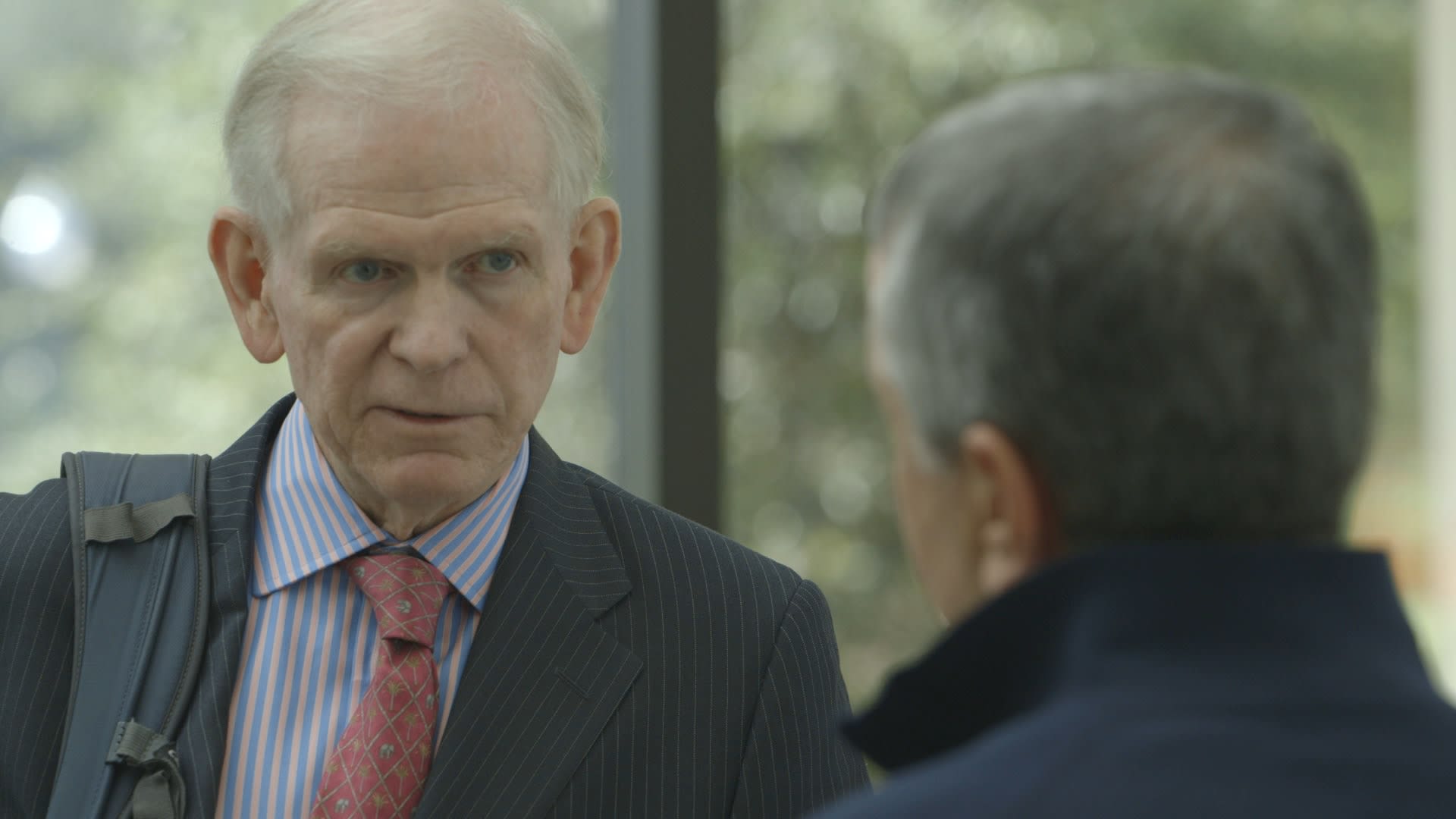

Jeremy Grantham, famed trader with a history of contacting marketplace crashes, said Wednesday the burst of many-asset bubbles he is been warning of has still to take place irrespective of 2022’s excessive volatility. “The latest superbubble options an unprecedentedly harmful combine of cross-asset overvaluation (with bonds, housing, and shares all critically overpriced and now quickly dropping momentum), commodity shock, and Fed hawkishness,” Grantham stated in a take note printed Wednesday . “Each cycle is distinctive and unique – but each and every historical parallel implies that the worst is nonetheless to arrive.” Grantham, the co-founder of Grantham Mayo van Otterloo in 1977, is a widely-adopted investor and market place historian with a keep track of report of figuring out market bubbles. He foresaw the 2008 bear market place and the dot-com bubble-bursting of 2000. The 83-calendar year-outdated trader mentioned superbubbles choose many phases. Following the bubble forms and a setback transpires, like it did in the 1st 50 percent of the calendar year, there will commonly be bear industry rallies in advance of the market hits the base, he claimed. “Bear market place rallies in superbubbles are simpler and quicker than any other rallies,” Grantham explained. At the intraday peak on August 16, the S & P 500 had recovered 58% of its losses from its June lower. The magnitude of the bear-current market comeback seemed “eerily identical” to other historic superbubbles through 1929, 1973 and 2000, Grantham explained. Grantham claimed the up coming leg down for the sector is probably to be pushed by slipping earnings margins. He also pointed to a number of near-time period complications like Russia’s invasion of Ukraine, fiscal tightening and China’s Covid outbreak. In Might, when the S & P 500 was down about 20% from its all-time substantial, Grantham termed for stocks to at the very least double their losses. Now the S & P 500 is 17.9% off its peak as of Wednesday’s near. “If heritage repeats, the enjoy will after once more be a Tragedy,” Grantham explained.