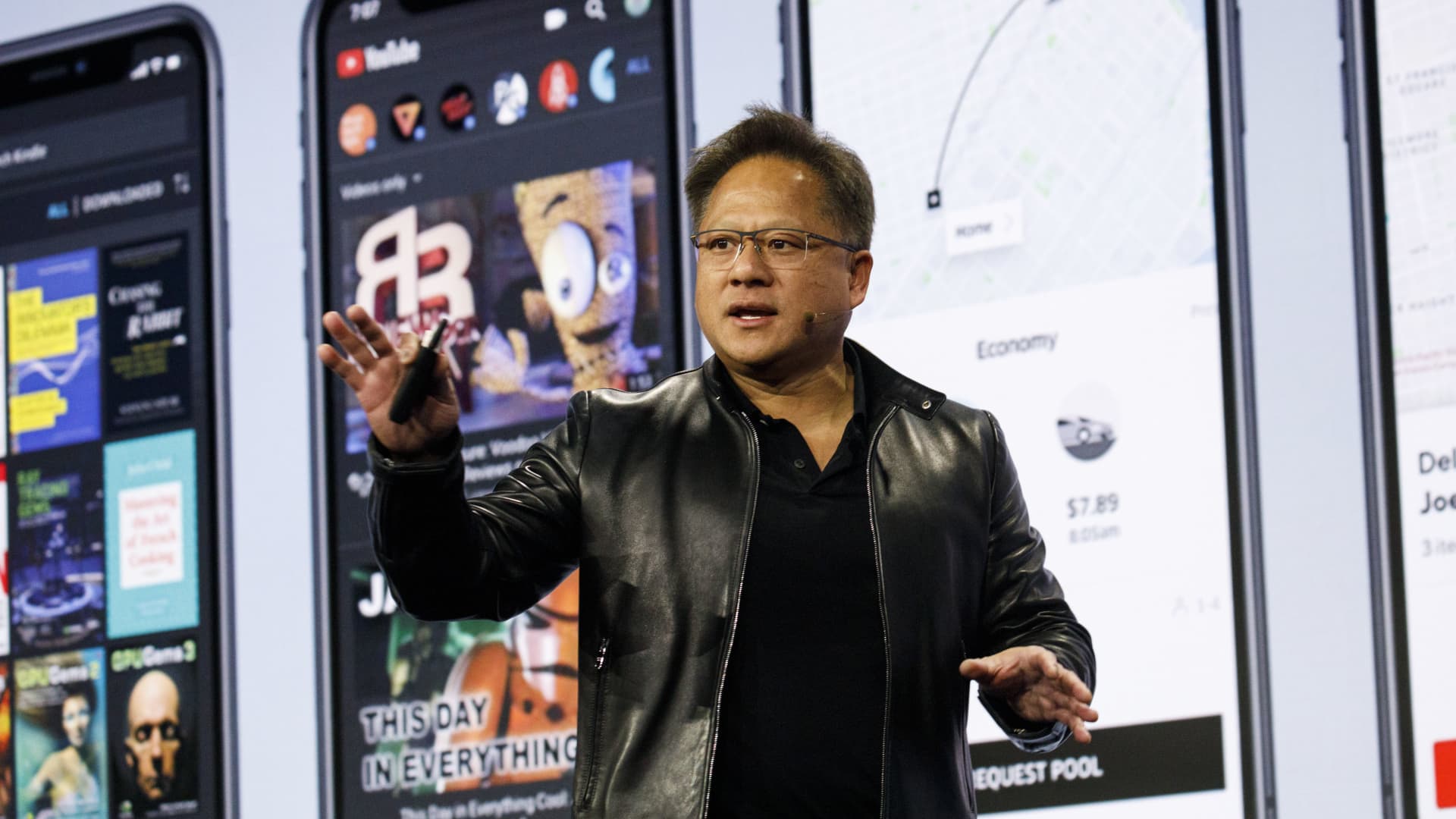

Jen-Hsun Huang, president and main government officer of Nvidia Corp., speaks for the duration of the company’s occasion at Cell Planet Congress Americas in Los Angeles on Oct. 21, 2019.

Patrick T. Fallon | Bloomberg | Getty Visuals

Nvidia documented second quarter earnings that missed Wall Street anticipations for earnings and earnings for each share.

The report is in line with Nvidia’s preliminary earnings two months ago. The chipmaker warned that it would skip Wall Road estimates and that development experienced slowed substantially for the reason that of disappointing gaming profits driven by macroeconomic disorders. It also warned its gross margin would fall.

Nvidia missed on earnings but Refinitiv estimates did not adjust right after the corporation warned on guidance and claimed it expected to report $6.7 billion in the quarter. Nvidia inventory fell in excess of 4% in prolonged trading.

Here’s how Nvidia did vs . Refinitiv consensus estimates:

- EPS: $.51, modified, vs . $1.26 anticipated

- Revenue: $6.7 billion versus $8.10 billion expected

The chipmaker explained it expected $5.9 billion in revenue in its fiscal third quarter, as opposed to Refinitiv consensus estimates of $6.95 billion.

Nvidia’s gaming section revenue was down 33% calendar year-in excess of-12 months to $2.04 billion, which was a sharper decrease than the corporation predicted. Nvidia explained that the skip was mainly because of reduced sales of its gaming products and solutions, which are primarily graphics playing cards for PCs.

“Macroeconomic headwinds throughout the globe drove a sudden slowdown in purchaser desire” for the company’s gaming solutions, Nvidia CFO Colette Kress stated on a connect with with analysts.

Nvidia reported it would regulate selling prices with its suppliers to tackle “demanding marketplace situations” for the sector that it reported it predicted to persist through the present quarter.

The company’s information centre enterprise did slightly far better. It rose 61% on an yearly foundation to $3.8 billion, driven by what the company calls “hyperscale” consumers, which are significant cloud providers.

Nvidia also has a few smaller lines of small business. Its expert visualization enterprise, which sells graphics chips for business uses, declined 4% yearly to $496 million. Automotive stays little, even though it amplified 45% year-over-year to $220 million. Nvidia mentioned that income from its committed cryptocurrency mining chips, CMP, was “nominal,” contributing to a 66% yearly lessen in its OEM and other group.

Nvidia stock is down more than 42% so considerably due to the fact the starting of the yr. It experienced been a pandemic darling, increasing intensely as operate-from-house prompted purchases of graphics playing cards and server chips, supercharging Nvidia’s enterprise and driving 61% profits expansion in fiscal 2022.

In Might, Nvidia explained it would slow its tempo of employing in the facial area of macroeconomic challenges.

Confined visibility into cryptocurrency mining demand

Nvidia’s achievement in the past two a long time has been largely attributed to the good quality of its most current era of graphics playing cards, which had been in hot desire for Computer system gaming throughout the pandemic.

But inquiries continue being about whether or not Nvidia’s development was partly pushed by cryptocurrency miners, who like Nvidia’s graphics cards simply because they are efficient at mining Ethereum.

In May perhaps, Nvidia mentioned it would fork out $5.5 million as aspect of a settlement with the SEC about how it knowledgeable buyers about how cryptocurrency was stoking need for its graphics playing cards in 2017. Considering the fact that then, Nvidia has claimed it isn’t going to have visibility into how a great deal cryptocurrency has an effect on the need for its solutions, even as cryptocurrency charges have plunged this year.

“Volatility in the cryptocurrency market – such as declines in cryptocurrency rates or modifications in strategy of verifying transactions, together with evidence of get the job done or proof of stake – has in the earlier impacted, and can in the upcoming impression, need for our items and our skill to precisely estimate it,” CFO Kress explained in a statement.

“We are not able to properly quantify the extent to which lowered cryptocurrency mining contributed to the decline in Gaming need,” Kress ongoing.