Santa Claus gestures during the 96th Macy’s Thanksgiving Day Parade in Manhattan, New York City, U.S., November 24, 2022.

Brendan Mcdermid | Reuters

Here are the most important news items that investors need to start their trading day:

1. Sleigh time?

Maybe Santa is going to deliver for the stock market, after all. There are still two trading days left till Christmas, and Wednesday showed stocks still have rallies in them, even during this otherwise sluggish month. The major indices surged, with the Dow jumping more than 500 points, and the S&P rising 1.49% and the Nasdaq posting a 1.54% gain. Still, stocks are on course to finish December in the red and potentially end up finishing their worst yearly performance in 14 years. On Thursday, investors will chew over the latest jobless data claims. Read live markets updates here.

2. Micron cutting thousands of jobs

Semiconductor maker Micron, squeezed by declining demand for personal computers, said it would reduce its workforce by about 10%, while also suspending bonuses. That amounts to a few thousand staffers, as a recent filing showed the company had about 48,000 employees. Micron announced the decision as it posted its latest quarterly results and forward guidance, both of which fell below Wall Street’s expectations. “In the last several months, we have seen a dramatic drop in demand,” CEO Sanjay Mehrotra said in prepared remarks.

3. SBF’s ex-colleagues cooperating with feds

FTX logo displayed on a phone screen is seen through the broken glass in this illustration photo taken in Krakow, Poland on November 14, 2022.

Jakub Porzycki/NurPhoto via Getty Images

If you’ve been following the collapse of crypto exchange FTX and the prosecution of its founder and mastermind, Sam Bankman-Fried, you’ve probably been wondering why we haven’t heard from Gary Wang and Caroline Ellison. And if you suspected they were cooperating with the feds, you were right. On Wednesday night, federal prosecutors revealed that Wang, a co-founder of FTX, and Ellison, who was co-CEO of sister firm Alameda Research, had agreed to plead guilty to federal crimes while working with authorities on the case of the fallen crypto firm. The news broke while Bankman-Fried, aka SBF, was on a flight from the Bahamas to the United States to face his own prosecution.

4. Zelenskyy lauds U.S. ‘investment’

Ukrainian President Volodymyr Zelenskyy took Washington by storm Wednesday in what’s been hailed as a triumphant visit. It was his first known excursion beyond Ukraine’s borders since Russia launched its unprovoked invasion on the former Soviet country in February. Zelenskyy’s trip to the U.S. capital included a meeting and a press conference with President Joe Biden at the White House and a rousing, 32-minute address to a joint session of Congress. “Thank you for both financial packages you have already provided us with and the ones you may be willing to decide on,” he told lawmakers, who are set to approve more than $44 billion in new aid for Ukraine. “Your money is not charity. It is an investment in global security and democracy, that we handle in the most responsible way.”

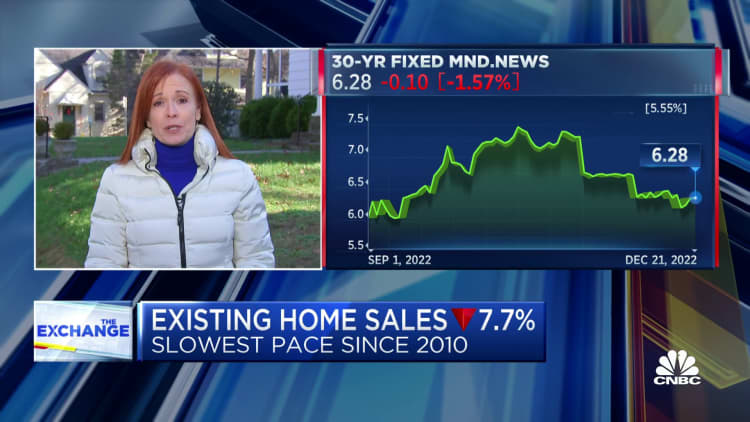

5. Home sales have fallen for 10 straight months

Another day, another grim scrap of data from the housing market. Home sales tumbled a deeper-than-expected 7.7% in November from October, marking the tenth consecutive month of sales declines. The sales reflect contracts signed in September and October, when interest rates had peaked before coming down a bit in recent weeks. (Although they’re still about double what they were at the beginning of this year.) “In essence, the residential real estate market was frozen in November, resembling the sales activity seen during the Covid-19 economic lockdowns in 2020,” said Lawrence Yun, the chief economist for the National Association of Realtors.

– CNBC’s Samantha Subin, Kif Leswing, MacKenzie Sigalos, Rohan Goswami, Christina Wilkie, Chelsey Cox and Diana Olick contributed to this report.

— Follow broader market action like a pro on CNBC Pro.