Stunning and colourful aerial see of Mumbai skyline during twilight noticed from Currey Road, on February 16, 2022 in Mumbai, India.

Pratik Chorge | Hindustan Instances | Getty Images

India’s inventory markets have staged file-breaking rallies this calendar year, creating the place a most loved among the its Asia-Pacific counterparts.

The Nifty 50 index has frequently notched fresh new all-time highs, achieving still yet another peak on Tuesday. The index is established for an eighth yr of gains, up much more than 15% year-to-date.

Optimism about India’s development prospective customers, elevated liquidity and higher domestic participation have all contributed to the surge in stock marketplaces. In truth, India’s inventory market price has overtaken Hong Kong’s to grow to be the seventh biggest in the earth.

As of the stop of November, the whole current market capitalization of the Nationwide Stock Trade of India was $3.989 trillion as opposed to Hong Kong’s $3.984 trillion, according to details from the Entire world Federation of Exchanges.

Figures from the WFE also confirmed that India’s NSE noticed much more new inventory listings than the HKEX. India’s stock market place had 22 new listings vs. Hong Kong’s seven, as of November.

Below are the five factors why India’s stock marketplaces have achieved new highs this yr

Development prospective customers

India has been a single of South Asia’s swiftest escalating economies, with expectations only constructing up for future year.

The world’s most populous region has grown at a continually potent speed this calendar year, with the most recent studying on 3rd-quarter GDP demonstrating a significantly increased-than-expected progress charge of 7.6%.

Bets on India driving advancement in Asia have also been growing. S&P Global predicted India’s GDP for the fiscal calendar year ending March 2024 hit 6.4%, additional than its previously forecast of 6%.

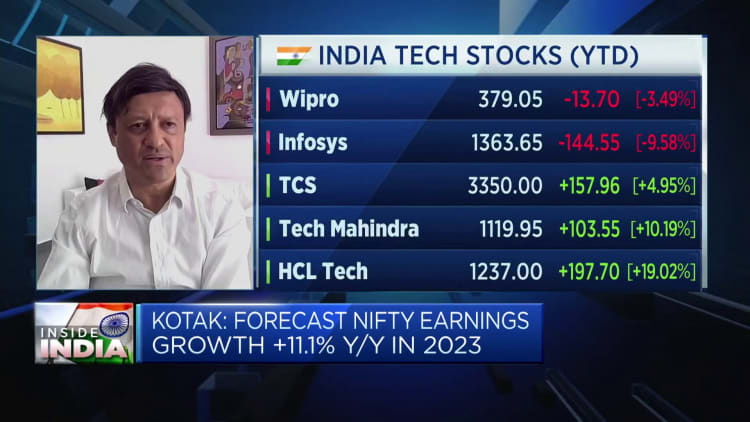

Solid earnings

The Indian inventory market has also demonstrated audio fundamentals and robust earnings, which are predicted to grow via 2024.

HSBC forecasts earnings growth of 17.8% for India in 2024 — among the speediest rates in Asia. Sectors such as banking institutions, well being treatment and electricity, which have presently carried out very well this 12 months are most effective positioned for 2024, according to HSBC.

Sectors these as autos, shops, real estate and telecoms ended up also comparatively effectively positioned for 2024, even though quick-relocating customer products, utilities and substances are amid those people HSBC claimed had been unfavorable.

Domestic participation

There has also been an uptick in domestic participation in Indian stock markets this 12 months, particularly in superior-growth locations, in accordance to study by HSBC.

“When international buyers tend to be lively in large caps, it is local buyers that dominate the little and mid-cap room, which partly clarifies the outperformance – fund flows into midcap-modest strategies of domestic MFs (i.e. mutual cash with a mandate to devote in smaller/midcaps) have been disproportionately superior,” HSBC pointed out.

It also expects this craze to keep on into the subsequent yr.

Charge cuts are coming

The Reserve Financial institution of India held its main lending fee regular at 6.5% past Friday and claimed its expects the country to grow at a speed of 7% this calendar year. The central bank did alert that inflation, even as it continues to amazing, nevertheless remains higher than its target as fundamental rate pressures were stubborn.

That, however, does not indicate sector players are not anticipating price cuts subsequent yr.

“We count on the plan pause to be extended for now and hope 100bp (basis points) of cumulative level cuts setting up from August 2024,” analysts at Nomura wrote in a client notice.

Reduced lending premiums normally enhance liquidity and raise additional chance-taking sentiment in stock markets.

Plan continuity

As India gears up for a large election yr in 2024, marketplaces keep on being optimistic on even more plan continuity.

Analysts predict it could be yet another victory for the ruling nationalist Bharatiya Janata Social gathering, with modern polls and recent point out elections showing the correct-wing BJP could retain electric power.

“The ruling Bharatiya Janata Bash (BJP) outdid its national and regional rivals at the just lately held point out elections. This solid operate fed anticipations of political balance at the impending general elections in April/Might24, addressing before problems that a weak demonstrating at the state polls may possibly have stoked a fiscally populist agenda in the coming months,” DBS senior economist Radhika Rao explained in a customer take note.