A image of Fenix Maritime Companies rail terminal on June 8, 2023, taken by a trucker.

The “sluggish and go” pace of the Global Longshore and Warehouse Union workforce at West Coast ports has slowed floor port productivity to a crawl. As a consequence, source chain intelligence organization MarineTraffic information reveals what it is calling a “considerable surge” in the normal range of containers ready outdoors of port limitations.

At the Port of Oakland, for the duration of the 7 days of June 5, the regular TEUs (ton equal models) waiting off port limitations rose to 35,153 from 25,266, in accordance to MarineTraffic. At the Port of Los Angeles and Prolonged Seashore, California, the ordinary TEUs waiting off port limitations rose to 51,228 from 21,297 the former week, explained a MarineTraffic spokeswoman.

The value of the mixed 86,381 containers floating off the ports of Oakland, Los Angeles, and Prolonged Beach arrived at $5.2 billion, dependent on a $61,000 price for each container, and customs knowledge.

In accordance to facts completely pulled for CNBC by Vizion, which tracks container shipments, the 7-day price for a container cleared by the Port of Oakland is working at 58% at Port of Extended Beach it is 64% and at Port of Los Angeles it is 62%.

“Our details shows that vessels will continue on arriving at West Coast ports in the coming days with important quantities of cargo to unload,” explained Kyle Henderson, CEO of Vizion. There are no indications at this time that ocean carriers have ideas to cancel any sailings to these ports, he reported, but he extra, “If these labor disputes keep on to have an impact on port effectiveness, we could see backlogs comparable to these knowledgeable during the pandemic. Clearly, which is the final point that any shipper desires as we change the corner into the back half of the yr and peak season.”

Logistics administrators with information of the way the union rank-and-file displeased with unresolved difficulties in negotiations with port administration are influencing operate shifts convey to CNBC the slowdown can be attributed to proficient labor not exhibiting up for perform. CNBC has also acquired that at find port terminals, requests for more operate made by means of formal do the job orders are not remaining put on the wall of the union hall for achievement. The Pacific Maritime Association, which negotiates on behalf of the ports, is not permitted in the union corridor to see if the terminal orders are in fact getting asked for. CNBC has been explained to that if the added job postings ended up being place up the details would display they are not staying crammed. Only authentic labor ordered from the PMA is being filled.

The PMA said in a statement on Friday afternoon that concerning June 2 and June 7, the ILWU at the Ports of Los Angeles and Extensive Seashore refused to dispatch lashers who safe cargo for trans-Pacific voyages and unfasten cargo after ships get there. “Devoid of this crucial operate, ships sit idle and are unable to be loaded or unloaded, leaving American exports sitting at the docks unable to attain their place,” the assertion browse. “The ILWU’s refusal to dispatch lashers had been aspect of a broader effort to withhold necessary labor from the docks.”

PMA cited a failure on Wednesday morning to fill 260 of the 900 work ordered at the Ports of Los Angeles and Extensive Seaside, and in whole, 559 registered longshore personnel who came to the dispatch corridor have been denied function options by the union, PMA asserted in its assertion.

“Every change with no lashers working resulted in much more ships sitting idle, occupying berths and resulting in a backup of incoming vessels,” it stated.

Nonetheless, the PMA mentioned ILWU’s decision to prevent withholding labor has authorized terminals at the Ports of Los Angeles and Prolonged Seaside to avert, for now, “the domino effect that would have resulted in backups not witnessed considering that final year’s supply chain meltdown.”

The PMA cited “generally improved” functions at the Ports of Los Angeles, Extensive Beach front, and Oakland, but at the Ports of Seattle and Tacoma, a continuation of “major slowdowns.”

The ILWU has declined to remark, citing a media blackout all through ongoing labor talks.

Truck and container backups

The average truck turns to go in and out of the West Coast ports are up.

A trucker ready for a container at LA’s Fenix Marine Companies terminal shared photos from their truck with CNBC showing congestion on both equally rail and the road where truckers wait around to pick up their containers.

Shippers are turning out to be increasingly concerned about the prospective need to come across alternate offer chain options.

A spokesperson for Long Seaside, California-dependent Cargomatic, which focuses on drayage and limited-haul trucking logistics, reported it is just not nonetheless looking at trade diversions, but extra, “As a countrywide drayage spouse, we have contingency ideas designed in with capacity completely ready to assistance our customers anywhere in the U.S. We know that shippers are really nervous and it is only a subject of time just before they pivot if this condition turns into prolonged.”

The PMA stated in its assertion that even even though some port functions have improved, “the ILWU’s recurring disruptive perform steps at strategic ports together the West Coast are progressively causing companies to divert cargo to additional customer-pleasant and reputable locations along the Gulf and East Coasts.”

West Coastline ports, which had misplaced substantial volume to East Coastline ports around the previous yr due to volatility in the labor contract talks, had in the latest months begun to acquire again volume.

A photo of a truck create up at Fenix Maritime Products and services terminal at the Port of Los Angeles waiting around to select up containers taken by a trucker.

Ocean freight intelligence company Xeneta states its facts demonstrates that container location freight rates jumped 15% in the 1st days of June as a outcome of quite a few simultaneous disruptions. Latest Panama Canal reduced water stages constrained cargo throughput, and quickly right after that, massive elements of U.S. West Coastline ports stopped dealing with inbound and outbound container trade.

“Shippers in lookup of much more trusted and resilient offer chains now contemplate their possibilities,” mentioned Peter Sand, main analyst at Xeneta. “The longer this drags on, the far more severe the consequences will be for shippers and terminals,” he claimed.

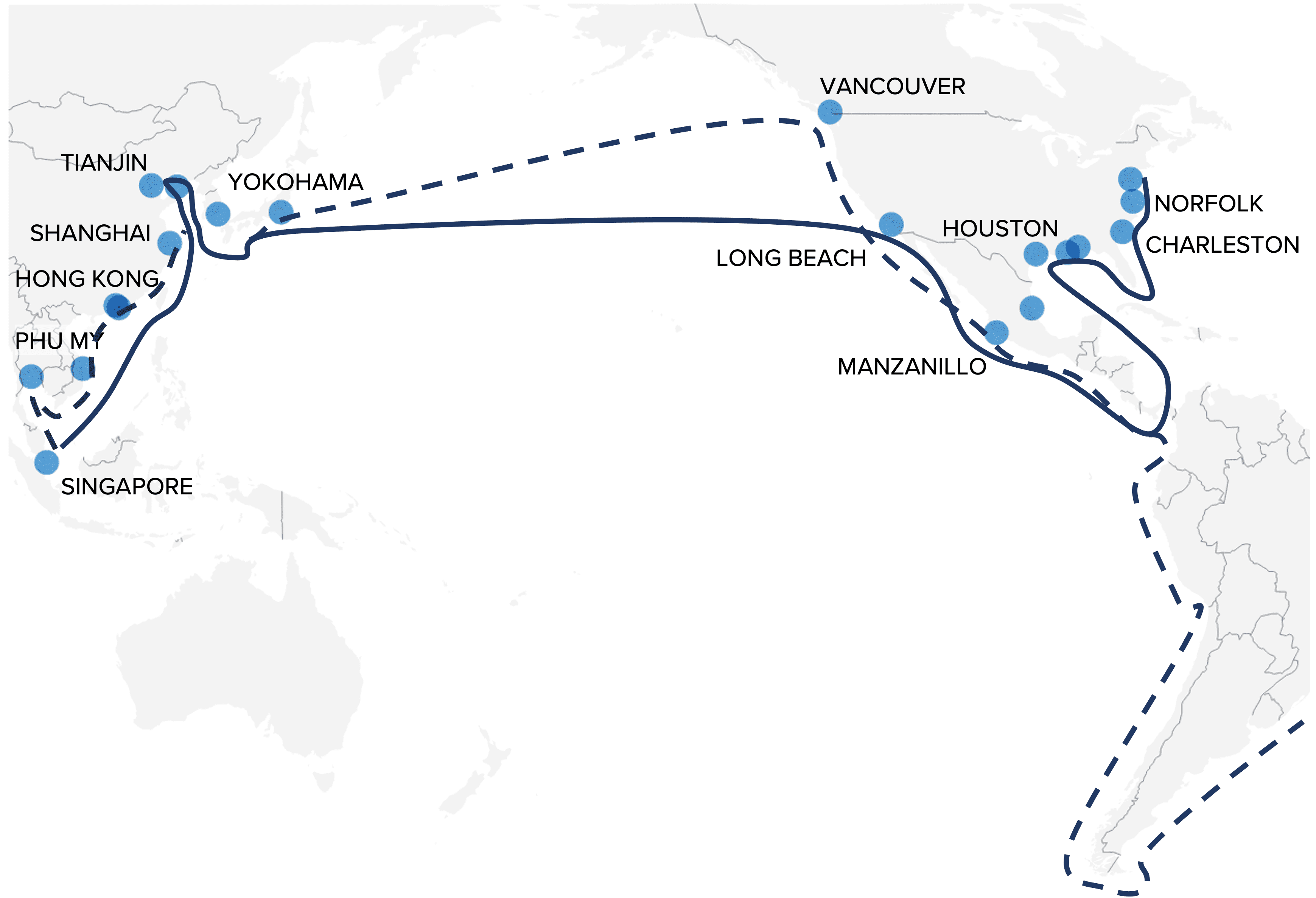

For the duration of Covid, the offer chain breakdowns saw the pileup of vessels waiting off the West Coast influence trade to move to the Gulf and East Coastline Ports. If vessels do start off diverting once more, there are excess costs tacked on to the merchandise getting transferred, which the shipper will be charged. If the vessels divert and go to the Gulf or East Coast ports, they have to possibly use the Panama Canal, in which additional expenses on leading of the standard extra costs are levied because the Panama Canal is in a crucial situation with decreased h2o concentrations thanks to drought.

Routes for monthly extended-term ‘tramp sailings’ from Asia to the Americas

— Main trade route — Alternate route

The Panama Canal’s h2o difficulties exacerbate costs that would be incurred in any trade re-routing. It has instituted excess weight prerequisites for vessels — they need to have to be lighter to go by means of. If the vessel is at or less than that excess weight prerequisite, shippers will be paying out supplemental expenses. In addition to the canal service fees, some ocean carriers like Hapag Lloyd have instituted a $260 container charge for traveling through the canal. CMA CGM is charging $300 a container. If vessels are heavier than the present need, they would be pressured to traverse the Pacific Ocean and go close to the horn of South The usa, which would include weeks of travel time and vacation prices.

“Vessel diversions are some of the most difficult functions that shippers and our shoppers offer with throughout a disaster,” reported Paul Brashier, vice president of drayage and intermodal at ITS Logistics. For the duration of the pandemic and its aftermath, containers destined for Los Angeles or Lengthy Beach would demonstrate up unannounced in Houston or Savannah with tiny to no see, he explained. “We have visibility purposes that alert us prior to the container arriving so we can reassign trucking potential at the new port. But if you do not have this visibility, if you are not ready to monitor the containers like that in true time, you could deal with 1000’s of pounds much more in shipping and delivery and D&D costs for each container to accommodate those alterations. That inflationary pressure adversely not only influences the shipper but the client of individuals goods,” he additional.

ITS Logistics elevated its freight rail warn level to “pink” this 7 days, signifying critical threat.

Source chain fees have arrive down substantially on a international basis, according to the Federal Reserve’s information, nevertheless they have been mentioned by Fed Chair Jerome Powell as 1 inflationary cause the central financial institution has no handle above. In a report by Georgetown economist Jonathan Ostry, the spike in shipping and delivery fees greater inflation by more than two percentage points in 2022.

“These slowdowns depart minor solutions for shippers who have containers presently en route to the West Coast,” mentioned Adil Ashiq, head of North America for MarineTraffic, who told CNBC before this week that the maritime supply chain concerns were being “breaking regular.”

“They could skip a port and go to a further West Coastline port, but they are all enduring concentrations of congestion,” he mentioned on Friday. “So do they hold out or divert and go to Houston as the following closest port to discharge cargo?”

If vessels do choose to reroute, it will insert days to their journey, which would hold off the arrival of the solution even a lot more.

For instance, if a vessel inbound from Asia decided to reroute to Houston, it would incorporate yet another 7 to 11 day journey to the Panama Canal. If a vessel is accredited to transit by means of the canal, that adds 8-10 hours of transit time. “You then have to include journey time after out of the canal to the port. So we’re on the lookout at conservatively, a 12 to 18 working day more hold off if a vessel decides to go to Houston immediately from the Canal. Even more, if you have to vacation all over South The united states,” he claimed.

Important sectors of the U.S. overall economy have been pleading with the Biden administration to stage in and broker a labor arrangement, which includes trade groups for the retail and producing sectors. On Friday, the U.S. Chamber of Commerce included its voice to this energy, expressing its considerations about a “major perform stoppage” at the ports of Los Angeles and Long Seaside which would possible price tag the U.S. financial system almost fifty percent a billion pounds a working day. It estimates a a lot more popular strike together the West Coastline could charge approximately $1 billion per working day.

“The ideal end result is an arrangement achieved voluntarily by the negotiating functions. But we are concerned the current sticking issue – an deadlock over wages and advantages – will not be settled,” U.S. Chamber of Commerce CEO Suzanne Clark wrote in a letter to President Biden.