Month: November 2023

OpenAI tender give is on track for January regardless of management fracas, sources say

Sam Altman, CEO of OpenAI participates in the “Charting the Route Ahead: The Long run of Artificial Intelligence” at the Asia-Pacific Economic Cooperation (APEC) Leaders’ 7 days in San Francisco, California, on November 16, 2023. Andrew Caballero-Reynolds | AFP | Getty Pictures OpenAI’s tender give, which would allow for staff members to provide shares in […]

Read More

Ulta Beauty shares pop as sales climb 6%

Shares of Ulta Beauty rose in after-hours trading Thursday, as the company said its third-quarter sales rose while shoppers showed once again they’re willing to spend on fragrances, skin care and more even when the budget is tight. The specialty beauty retailer raised the bottom end of its range for full-year sales and earnings expectations. […]

Read More

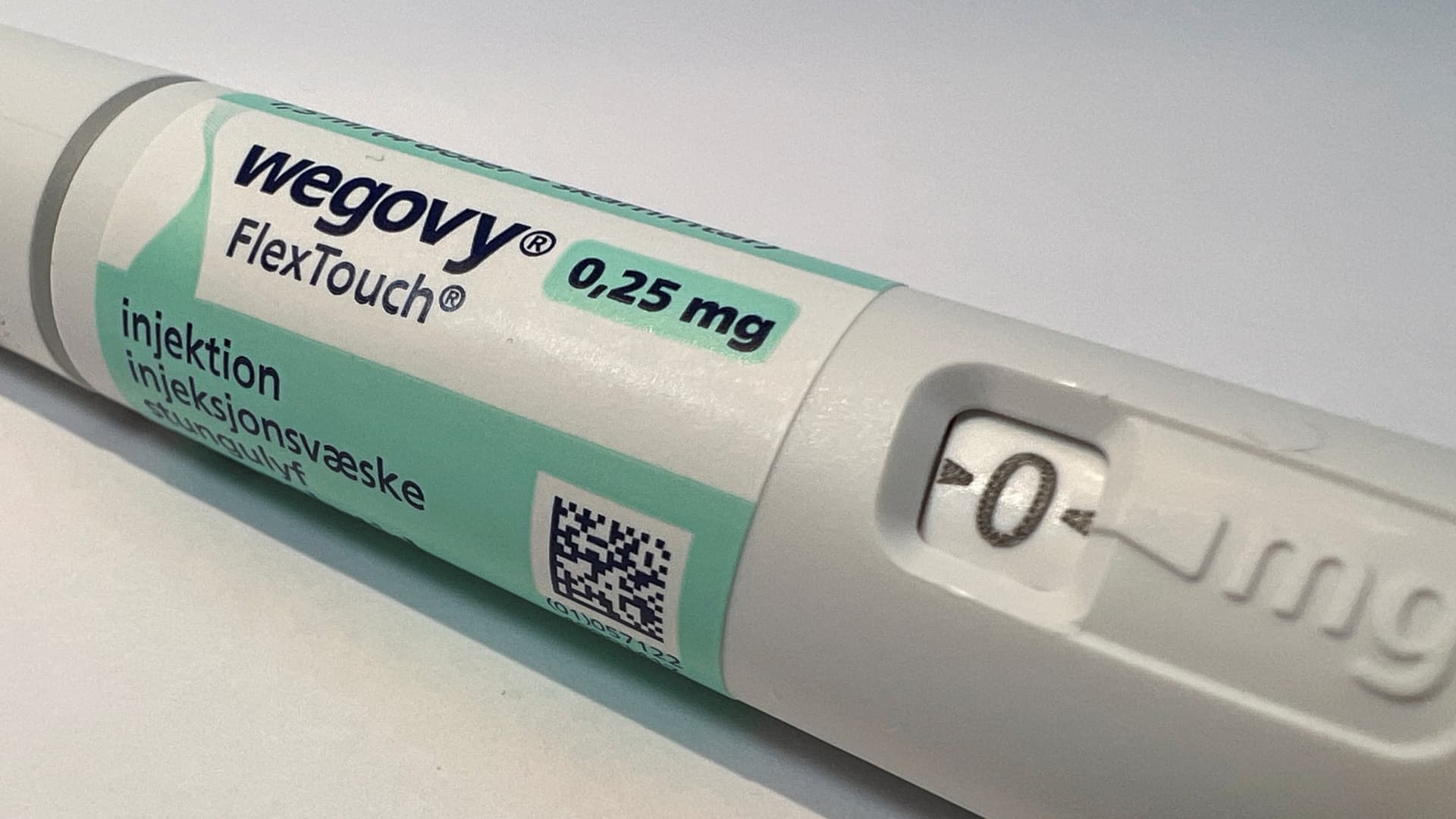

Novo Nordisk sues two pharmacies for allegedly selling tainted Wegovy, Ozempic knockoffs

A 0.25 mg injection pen of Novo Nordisk’s weight-loss drug Wegovy is shown in this photo illustration in Oslo, Norway, August 31, 2023. Victoria Klesty | Reuters Novo Nordisk on Thursday said it sued two compounding pharmacies in Florida for allegedly selling impure and “potentially unsafe” drugs claiming to contain semaglutide, the active ingredient in […]

Read More

Coinbase rallies a lot more than 60% in exact month that FTX and Binance founders brace for jail

Brian Armstrong, CEO of Coinbase, slammed the U.S. Securities and Exchange Fee. He also mentioned the cryptocurrency exchange is looking to invest more outside the house of the U.S. Carlos Jasso | Bloomberg | Getty Photographs In a month that saw two of the crypto industry’s foremost figures headed on the path to jail, Coinbase […]

Read More

Mars, accused of working with baby labor in its source chain, states it aims to finish the apply

Element of a not too long ago opened cocoa pod in Asikasu on Dec. 19, 2020. Cristina Aldehuela | Afp | Getty Photographs Candy large Mars claimed it aims to conclude the use of child labor in its provide chain following CBS Information documented that small children in Ghana are harvesting the cocoa that finds […]

Read More

How major retailers and Covid-era nostalgia helped revive the vinyl records industry

A stack of freshly pressed gold vinyl records at United Record Pressing. CNBC This story is part of CNBC’s new quarterly Cities of Success series, which explores cities that have been transformed into business hubs with an entrepreneurial spirit that has attracted capital, companies and workers. Once considered a dying industry, the vinyl record business […]

Read More

‘Sound of Freedom’ studio looks to build on crowdfunding success with new film ‘The Shift’

Neal McDonough stars as a mysterious man known as “the benefactor” in Angel Studio’s “The Shift.” Angel Studios “Sound of Freedom” broke the Hollywood mold this summer. Now, the studio behind the surprising smash is looking to follow-up that success with a science fiction thriller based on the Bible’s Book of Job. Angel Studios is […]

Read More

See inside Tennessee’s most expensive home at $65 million, just outside Nashville

This story is part of CNBC’s new quarterly Cities of Success series, which explores cities that have transformed into business hubs with an entrepreneurial spirit that has attracted capital, companies and employees. Twin Rivers Farm could break records as Tennessee’s priciest home if it fetches its $65 million asking price. The property is located just […]

Read More

Tesla established to expose Cybertruck facts at Austin deliveries event

The Tesla Cybertruck all through a tour of the Elkhorn Battery energy storage program in Moss Landing, California, on June 6, 2022. Nik Coury | Bloomberg | Getty Images Electric automobile maker Tesla is set to reveal details about its new and unconventional Cybertruck pickup on Thursday, a person working day soon after CEO Elon […]

Read More

Trump gag buy in fraud scenario reinstated by New York appeals court

Former U.S. President Donald Trump attends demo in a civil fraud circumstance that state Legal professional Standard Letitia James introduced from him, his grownup sons, the Trump Business and others, in New York Town, Oct. 3, 2023. Eduardo Munoz | Reuters A New York appeals courtroom Thursday reinstated a gag order on Donald Trump in […]

Read More