Month: August 2023

Asia markets established to tumble as traders wait around for China’s manufacturing facility exercise data

People today walk alongside a promenade up coming to Victoria harbour in Hong Kong on August 31, 2023, a working day ahead of the arrival of Typhoon Saola. (Image by ISAAC LAWRENCE / AFP) (Picture by ISAAC LAWRENCE/AFP via Getty Illustrations or photos) Isaac Lawrence | Afp | Getty Images Asia-Pacific markets are set to […]

Read More

International expansion is established to slow — but there are ‘pockets of resilience,’ Moody’s says

An aerial view demonstrates the Central Financial institution of India making, in Mumbai, India, 28 September, 2022. (Photo by Niharika Kulkarni/NurPhoto through Getty Photos) Nurphoto | Nurphoto | Getty Photographs The worldwide economy is set to sluggish down as inflation continues to be stickier than expected — but there may well be some “pockets of […]

Read More

‘Very sturdy strategy’: Fund supervisor makes a scenario for dividend stocks and names 5 to obtain

Dividend shares aren’t evergreen, but investing in them over numerous decades can pay off, according to a single portfolio supervisor. Their underperformance this year offers an chance, said Ben Kirby, who is also co-head of investments at Thornburg Financial commitment Management. “Dividend investing goes in and out of favor from one year to the upcoming, […]

Read More

Stock futures are tiny adjusted in advance of August payrolls report: Dwell updates

Traders perform on the floor of the New York Stock Trade through morning buying and selling on August 31, 2023 in New York Town. Michael M. Santiago | Getty Photographs Stock futures had been near the flat line Thursday night time as traders arrived off a mixed trading session and closed out a month that […]

Read More

Taylor Swift, Beyoncé and ‘Barbenheimer’ are lifting purchaser shelling out this quarter. But Morgan Stanley says it could not very last

Taylor Swift, Beyonce, Barbie, Oppenheimer Getty Illustrations or photos Buyer paying out could not be out of the woods. Genuine spending is envisioned to come in 1.9% bigger in the 3rd quarter, helped in section by stadium excursions from songs superstars Taylor Swift and Beyoncé, as perfectly as summertime motion picture blockbusters “Barbie” and “Oppenheimer,” […]

Read More

SentinelOne CEO says the cybersecurity business is not for sale

SentinelOne CEO Tomer Weingarten at the New York Stock Trade. Resource: NYSE SentinelOne, a cybersecurity enterprise that went public in 2021 and has however to see its inventory value exceed highs from that 12 months, is not for sale, Tomer Weingarten, its co-founder and CEO, told CNBC in an job interview Thursday. The comments adhere […]

Read More

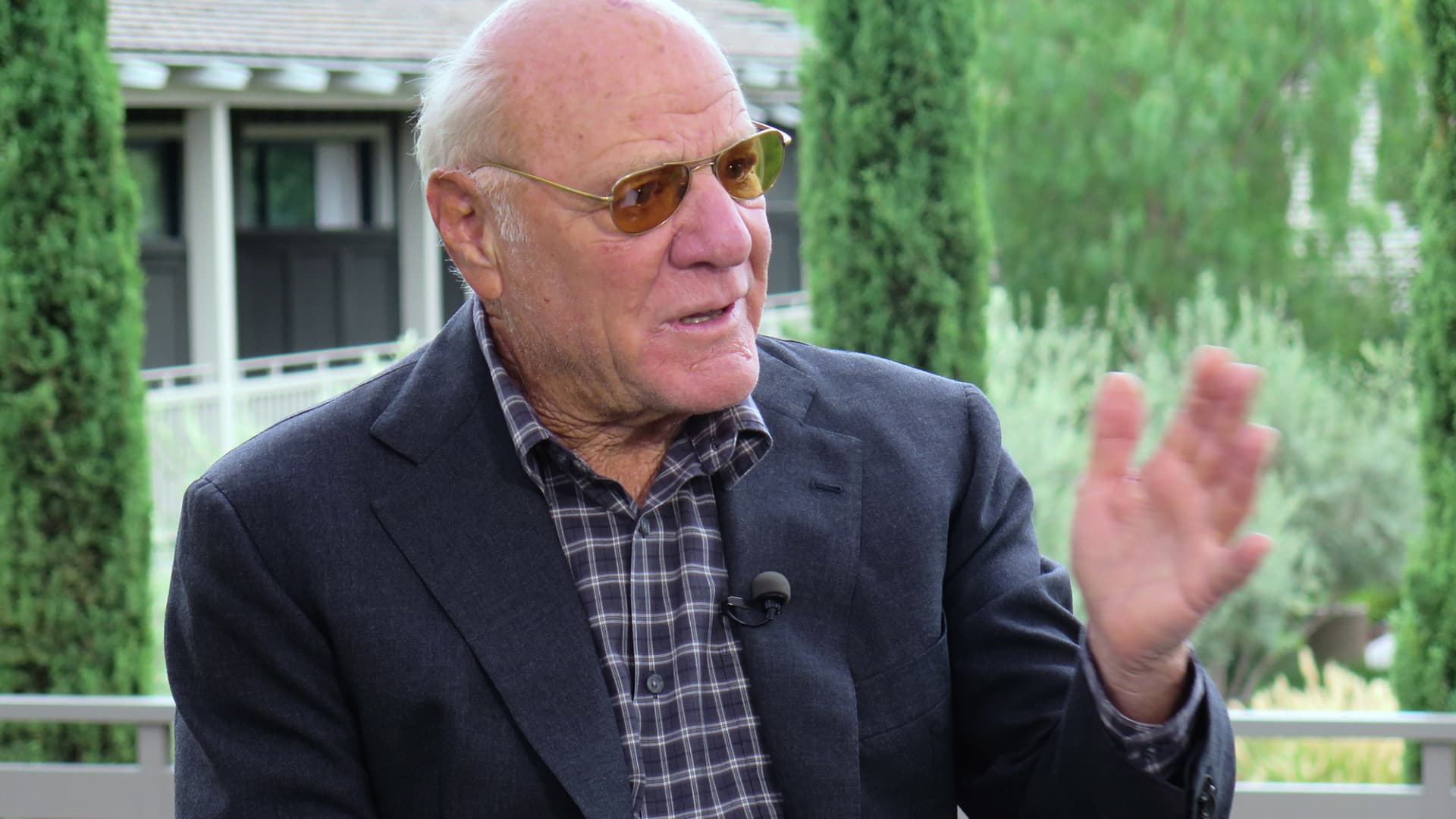

Hollywood studios should cut Netflix out of strike negotiations, Barry Diller says

Barry Diller Mike Newberg | CNBC Barry Diller is calling on the legacy Hollywood studios to end the dual writers and actors strikes, otherwise it’ll be “catastrophic” to the industry. The media mogul, speaking on the podcast “On with Kara Swisher,” said the strikes would only strengthen streaming giant Netflix during a tumultuous time for […]

Read More

Lululemon sees sales and profit jump 18%, boosts full-year guidance

A customer enters a Lululemon store on June 02, 2023 in Corte Madera, California. Justin Sullivan | Getty Images Lululemon raised its full-year guidance Thursday after reporting an 18% jump in both sales and profit for its fiscal second quarter, beating Wall Street’s estimates. The athletic apparel retailer now expects sales to be between $9.51 […]

Read More

U.S. health officials want to loosen marijuana restrictions. Here’s what it means

A worker sets up Florist Farms cannabis products on the first day of legal recreational marijuana sales at the Housing Works Cannabis Co. in New York, on Thursday, Dec. 29, 2022. Jeenah Moon | Bloomberg | Getty Images This week, the Health and Human Services Department asked the Drug Enforcement Agency to consider easing restrictions […]

Read More