Month: June 2023

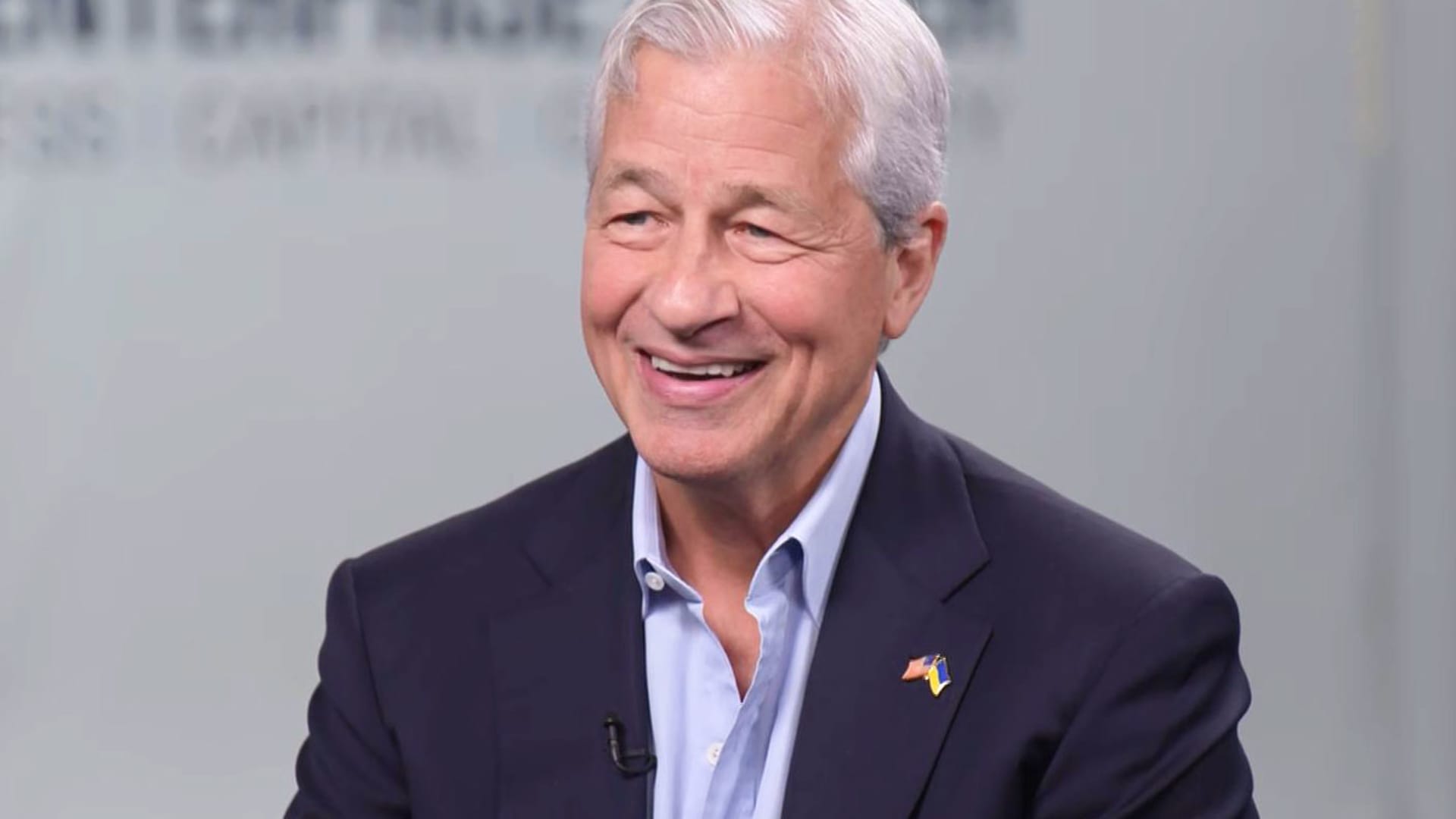

JPMorgan, Wells Fargo and Morgan Stanley to improve dividends right after clearing Fed stress exam

Essential Factors U.S financial institutions including JPMorgan Chase, Wells Fargo and Morgan Stanley explained Friday they prepare to elevate their quarterly dividends after clearing the Federal Reserve’s yearly tension test. JPMorgan options to increase its payout to $1.05 a share from $1 a share starting off in the 3rd quarter, the New York-based financial institution […]

Read More

Goldman in talks to offload Apple credit card, savings products to American Express, source says

Goldman Sachs is in talks to offload its Apple credit card and high-yield savings account products to American Express, a source told CNBC’s Leslie Picker. Goldman Sachs and Apple declined to comment. CNBC has also reached out to American Express. The talks come amid a broader retreat by Goldman from its largely failed consumer banking […]

Read More

FTC seeks to ban faux critiques with new proposed rule

FTC Chair Lina Khan speaks all through a Senate Commerce, Science and Transportation Committee affirmation listening to in Washington, D.C., April 21, 2021. Graeme Jennings | Bloomberg | Getty Images The Federal Trade Fee on Friday proposed a new rule that seeks to ban bogus on-line opinions, marking its most intense step still to thwart […]

Read More

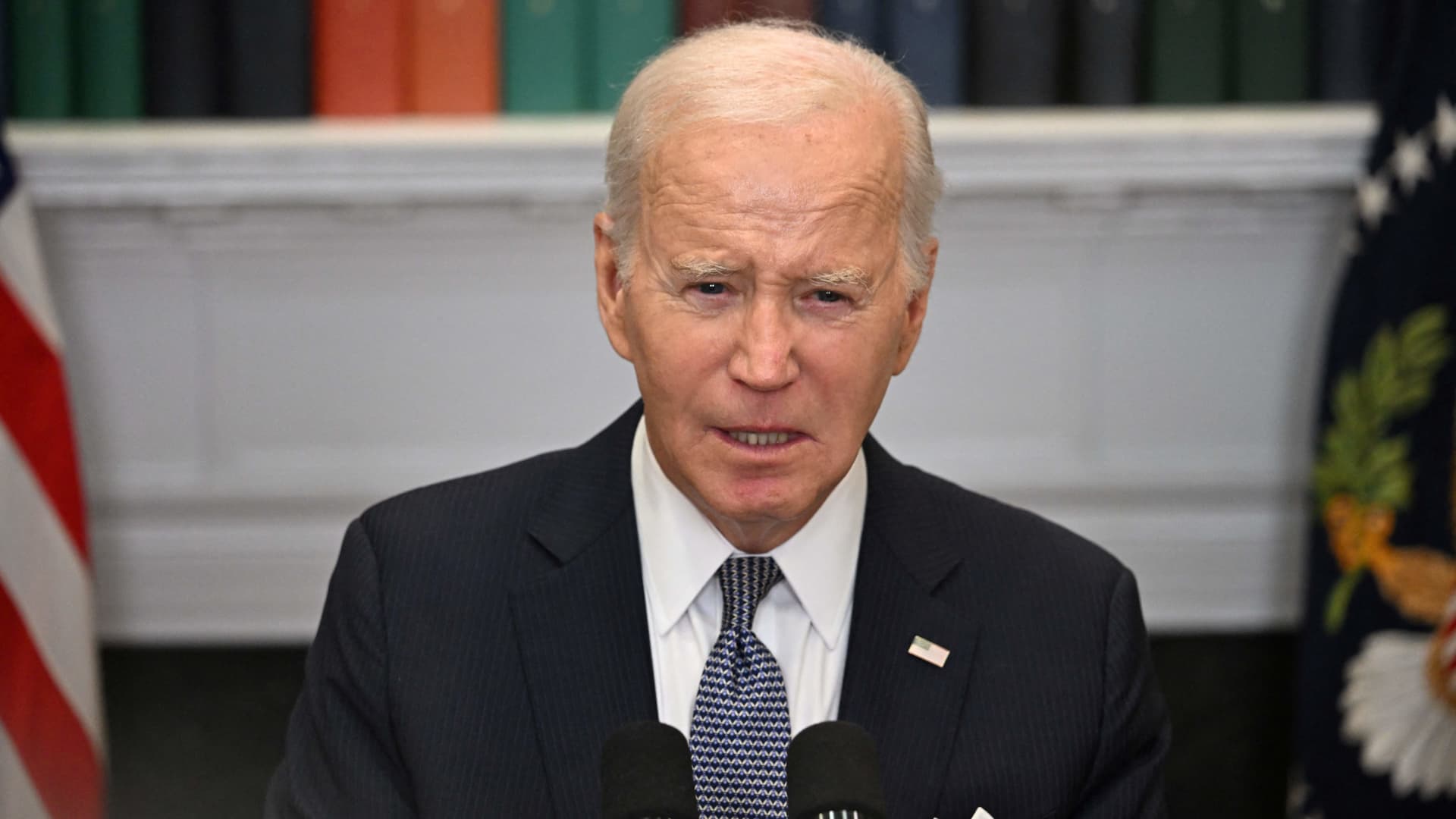

Biden claims he’s doing work on a new path to college student mortgage forgiveness right after Supreme Courtroom final decision

US President Joe Biden speaks about the US Supreme Court’s final decision overruling college student financial debt forgiveness, in the Roosevelt Area of the White Household in Washington, DC, on June 30, 2023. Jim Watson | AFP | Getty Visuals President Joe Biden instructed on Friday that he was seeking for another avenue to produce […]

Read More

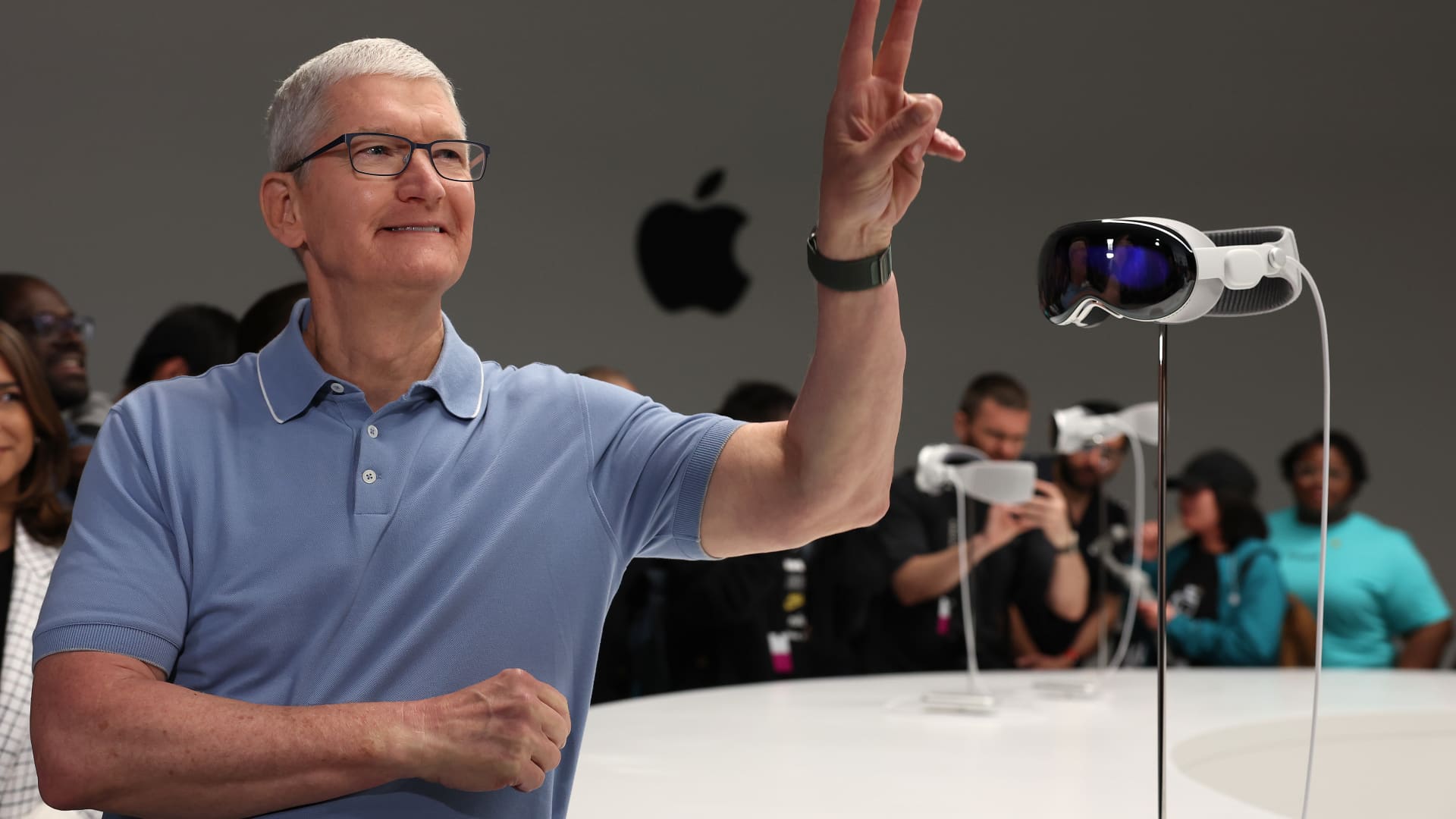

Tech shares close out finest 1st half in 40 decades, powered by Apple rally and Nvidia growth

Apple CEO Tim Cook dinner stands upcoming to the new Apple Eyesight Professional headset is shown all through the Apple Throughout the world Developers Conference on June 05, 2023 in Cupertino, California. Justin Sullivan | Getty Photographs The past time technological know-how stocks had a much better initial half, Apple was touting its Lisa desktop […]

Read More

The biggest takeaways from Microsoft’s courtroom showdown with the FTC over Activision Blizzard

Microsoft CEO Satya Nadella arrives at the U.S. DIstrict Court for the Northern District of California in San Francisco on June 28, 2023. Philip Pacheco | Bloomberg | Getty Images Microsoft and its current major acquisition target, video game publisher Activision Blizzard, have wrapped up their five days in court in San Francisco as the […]

Read More

4 North American cities now near worst air excellent in the world

Smoke shrouds the skyline of reduce Manhattan and A person World Trade Heart as the sun rises in New York City on June 30, 2023, as seen from Jersey City, New Jersey. Gary Hershorn | Corbis Information | Getty Illustrations or photos 4 of the 5 towns with the worst air good quality in the […]

Read More

White Household releases report on reflecting daylight to awesome the earth, no official analyze prepared now

Whole body sun, Climate alter, Heatwave very hot sunshine, Global warming from the sun and burning Chuchart Duangdaw | Moment | Getty Visuals On Friday, the White Residence released a federally mandated report on solar geoengineering, which is an umbrella phrase that describes approaches of reflecting sunlight absent from the earth to great the environment. […]

Read More