Month: March 2023

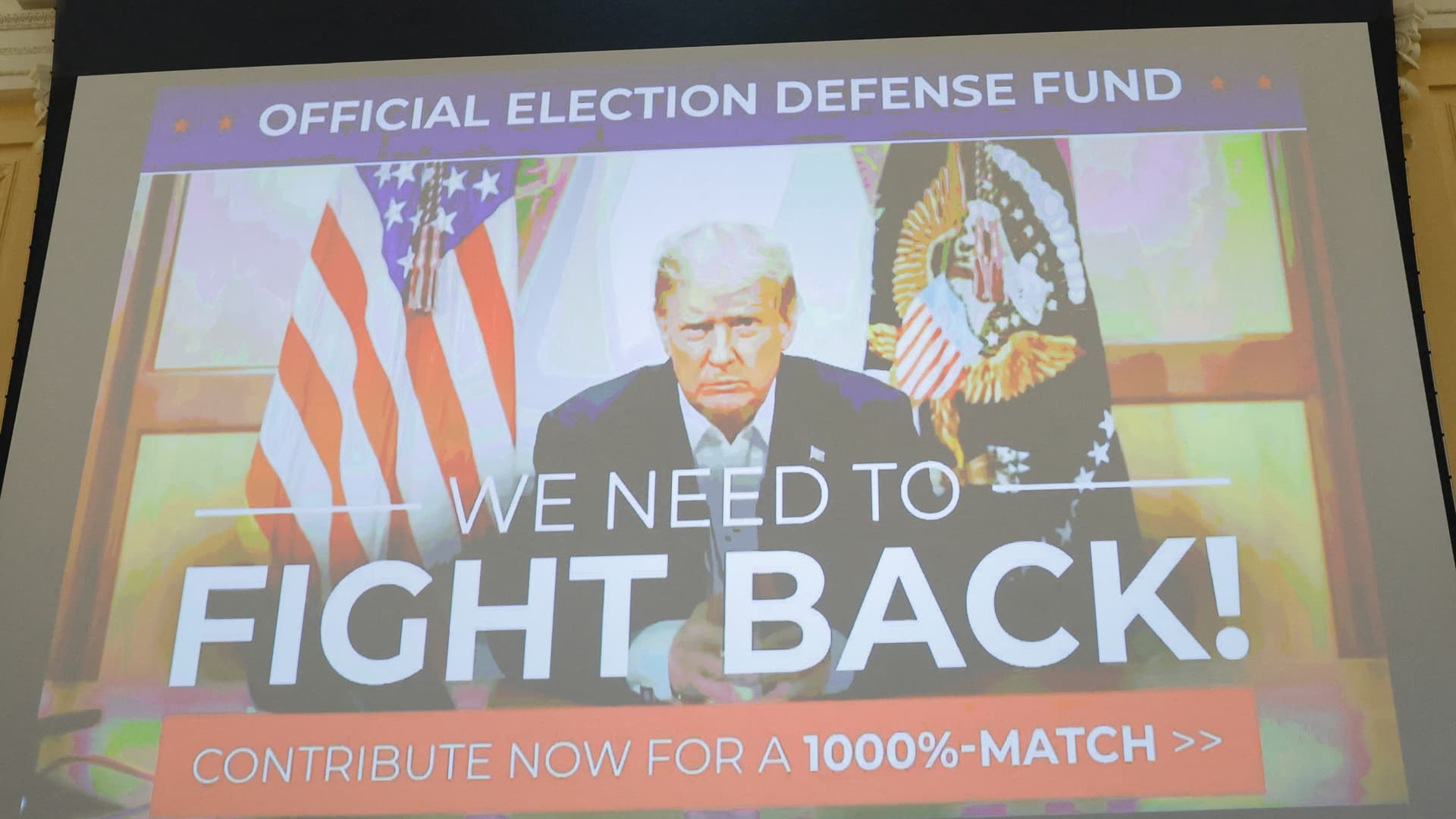

Judge rejects Fox motions, allows Dominion’s $1.6 billion defamation suit to go to trial

Members of Rise and Resist participate in their weekly “Truth Tuesday” protest at News Corp headquarters on February 21, 2023 in New York City. Michael M. Santiago | Getty Images News | Getty Images A Delaware judge on Friday said Dominion Voting’s $1.6 billion defamation lawsuit against Fox Corp. and its networks could go to […]

Read More

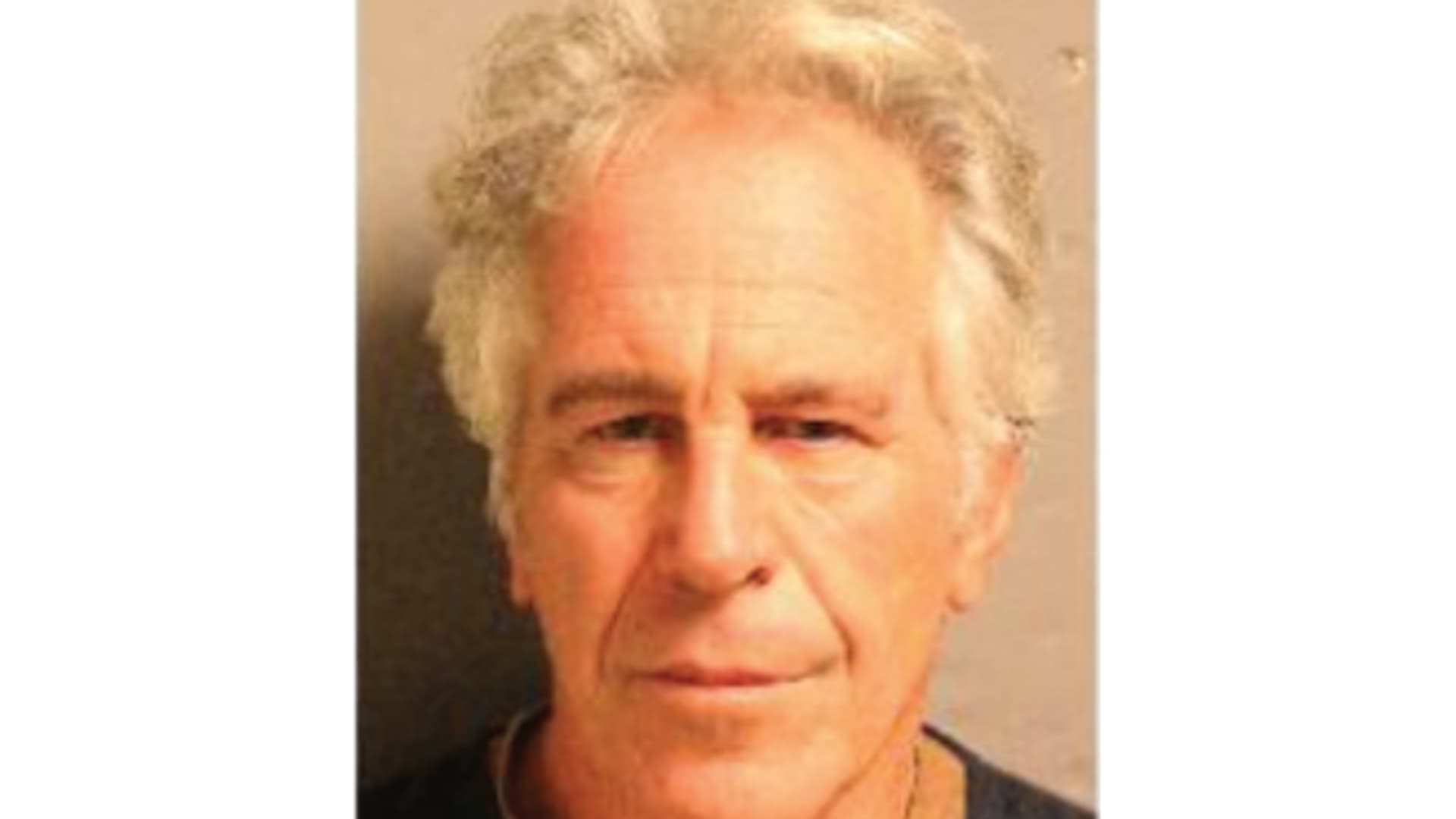

Google founder, previous Disney exec to get subpoenas in JPMorgan Epstein lawsuit

A mugshot of Jeffrey Epstein introduced by the U.S. Justice Office. Supply: U.S. Justice Division Google founder Sergey Brin, previous Disney executive Michael Ovitz, Hyatt Inns govt chairman Thomas Pritzker and a fourth billionaire, Mort Zuckerman will be subpoenaed in a lawsuit from JPMorgan Chase by the governing administration of the U.S. Virgin Islands associated […]

Read More

Millions will start losing Medicaid coverage as Covid safety net is dismantled

Hundreds of 1199SEIU health care workers staged a rally and sit to block 3rd avenue where some were arrested. They protested against health care cuts in Governor Kathy Hochuls budget on Medicare. Lev Radin | Lightrocket | Getty Images U.S. states on Saturday will start to kick as many as 15 million people off Medicaid […]

Read More

Here’s what went wrong with Virgin Orbit

Virgin Orbit crew poses at the opening bell ceremony as a 70 foot model rocket with satellites is placed in front of the NASDAQ in Times Square of New York City, United States on January 7, 2022. Tayfun Coskun | Anadolu Agency | Getty Images Not too long ago, Virgin Orbit was in rarified air […]

Read More

Shares could be shaky in the week ahead as sigh-of-reduction rally operates its class

The stock market place is about to enter a person of the seasonally strongest months of the year, but volatility could persist in the week ahead with fading momentum and a big positions report. The S & P 500 is established to finish the wild initially quarter on a higher observe as an inflation gauge […]

Read More

Biden administration appeals Texas court decision striking down free Obamacare coverage of preventive care

The Biden administration on Friday appealed a Texas federal judge’s decision to strike down free Obamacare coverage of preventive health-care services ranging from screenings for certain cancers and diabetes to HIV prevention drugs. U.S. Judge Reed O’Connor of the U.S. Northern District Court of Texas on Thursday struck down an Obamacare mandate requiring most private […]

Read More

Traders ‘are pretty frightened ideal now,’ economic psychologist suggests. These 2 methods can assist

With significant inflation, the danger of a recession and ongoing current market volatility, we’re in a period of superior monetary uncertainty. Understandably, a lot of traders “are very afraid correct now,” reported Brad Klontz, a psychologist and licensed money planner. And when we are pressured, our frame of reference tends to turn out to be […]

Read More

April is normally the best month for the Dow. Here’s how substantially it typically goes up and why

Not so cruel soon after all. If historical past repeats alone, the Dow Jones Industrial Normal ought to have a good April. April has traditionally been the best month for returns in the 30-inventory Dow Industrials, with regular gains of 1.9% going all the way again to 1950, according to the Inventory Trader’s Almanac . […]

Read More

This week’s top S&P 500 shares incorporate To start with Republic and this on line casino owner

Wall Road is barreling toward a winning week — and month — as it closes out a rocky initial quarter to 2023. All the significant indexes are up this week, with the Dow Jones Industrial Typical growing about 2.7%. The S & P 500 and Nasdaq Composite are up about 2.9% and 2.8%, respectively. In […]

Read More