Month: November 2022

Jeffrey Epstein estate settles Virgin Islands sex trafficking situation for above $105 million

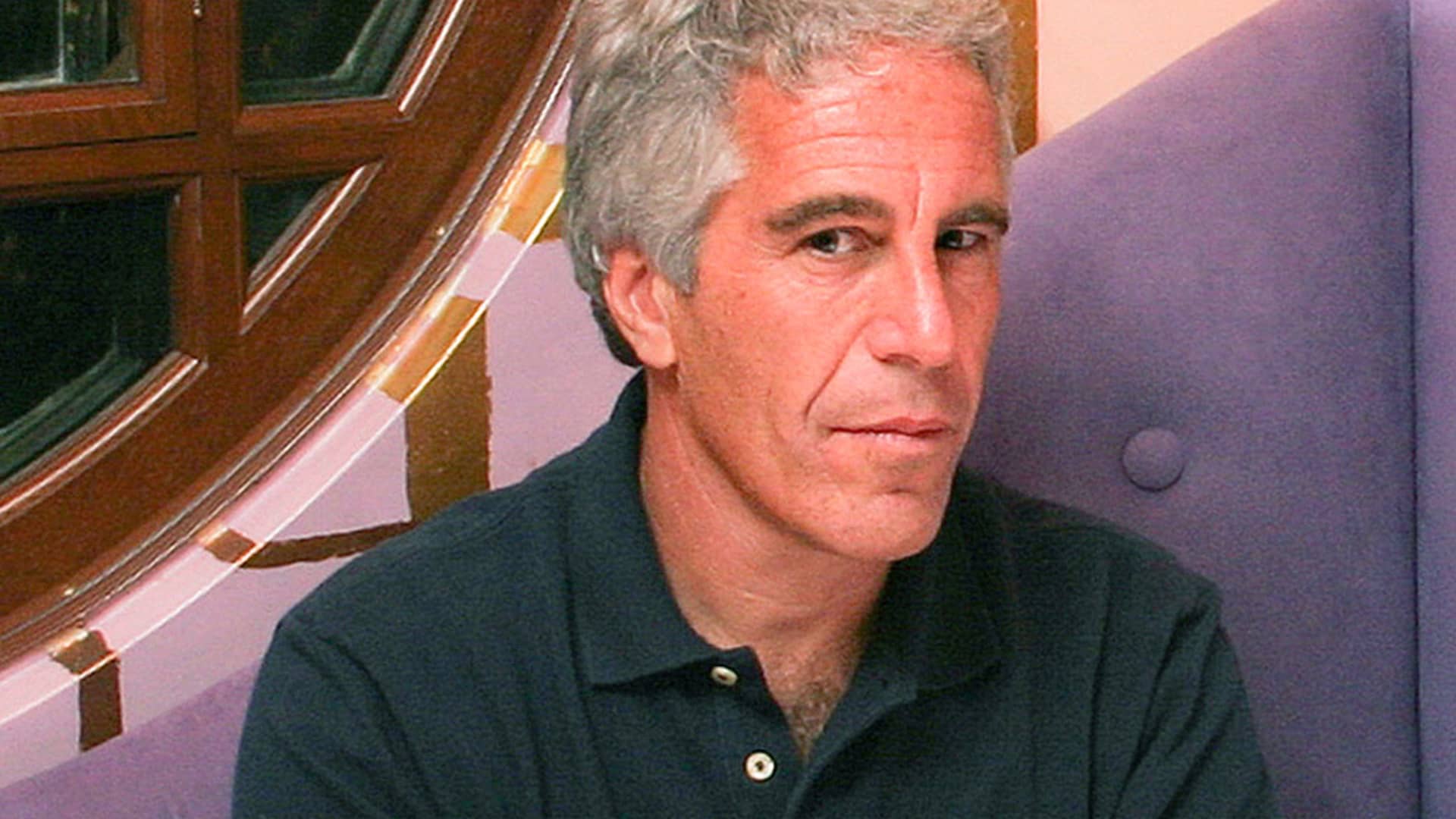

Jeffrey Epstein in Cambridge, MA in 1984. Rick Friedman | Corbis Information | Getty Illustrations or photos The estate of deceased intercourse offender Jeffrey Epstein and associated entities agreed to fork out the U.S. Virgin Islands extra than $105 million as portion of a settlement in a sexual intercourse trafficking and baby exploitation situation, the […]

Read More

UBS reveals world-wide stocks that will gain — or shed — when China reopens

Chinese stocks rose this week after the nation’s well being authorities claimed an uptick in Covid-19 vaccination premiums , which are regarded as important to reopening the region. A change in China’s strict zero-Covid policy would reverberate across the world, especially affecting significant world-wide organizations with major inbound links to the world’s next-biggest financial system. […]

Read More

Jim Cramer says to use Wednesday’s rally to reposition into profitable stocks

CNBC’s Jim Cramer urged investors to use the market’s rally on Wednesday to recalibrate their portfolios. “Use this moment to pivot yourself. Get out of the stocks I’ve been railing against for a full year,” he said, adding, “Get into the stocks of companies that make things and do stuff at a profit and return […]

Read More

Inventory futures tick higher after Wednesday’s rally

Traders on the ground of the NYSE, Nov. 1, 2022. Resource: NYSE Inventory futures ticked larger in overnight investing Wednesday. Futures tied to the Dow Jones Industrial Typical rose 13 details, or .04%, when those tied to the S&P 500 and Nasdaq 100 attained .25% and .21%, respectively. Salesforce’s stock get rid of 8% in […]

Read More

White Household weighs future release of crisis heating, crude oil reserves as winter nears

An aerial of the Strategic Petroleum Reserve storage at the Bryan Mound website seen on October 19, 2022 in Freeport, Texas. The most important casualties who will put up with the brunt of significant strength prices is neither the United States nor Europe — but emerging and producing nations, explained the head of International Vitality […]

Read More

Stocks earning the greatest moves just after hours: Salesforce, Snowflake, Costco, 5 Down below and a lot more

In this write-up 5 Price SNOW CRM Abide by your favourite sharesBuild Absolutely free ACCOUNT Signage on a Saleforce business office constructing in San Francisco, California, U.S., on Tuesday, Feb. 23, 2021. David Paul Morris | Bloomberg | Getty Images Look at out the providers earning headlines just after the bell: Salesforce — Salesforce’s inventory […]

Read More

‘I did not at any time try to commit fraud on any one,’ previous FTX CEO Sam Bankman-Fried claims

Tom Williams | CQ-Roll Simply call, Inc. | Getty Visuals Placing a contrite tone, former FTX CEO Sam Bankman-Fried claimed he “failed to do a good position” at upholding his obligations to regulators, shoppers, and investors in a hotly expected discussion with CNBC’s Andrew Ross Sorkin at the Dealbook Summit. “I did not at any […]

Read More

Salesforce stock falls more than 5% on earnings and unexpected departure of co-CEO Bret Taylor

Salesforce cofounder and co-CEO Marc Benioff speaks for the duration of the grand opening of the Salesforce Tower, the tallest creating in San Francisco, Calif., Tuesday, May well 22, 2018. Karl Mondon | Bay Spot News Group | Getty Illustrations or photos Salesforce reported earnings and income on Wednesday that defeat analyst anticipations. It also […]

Read More

Amazon CEO says Prime could become ‘standalone business,’ stands by layoffs

Amazon (AMZN) could potentially spin off its Prime streaming unit as a separate company, CEO Andy Jassy said Wednesday. During a wide-ranging interview at the The New York Times’ DealBook Summit , Jassy said that “overtime we have opportunities to make our Prime video business a standalone business that has very attractive economics.” Jassy also […]

Read More